In May of 2019, the Ethereum futures contract on Bitmex paid an annualized rate of 485% per annum over one eight-hour period.

Now, being you are new to crypto this visual may not move you much. But after you understand how profitable—and how safe—this trade is, trust me, the light will go on in your head

The ETHUSD futures contract on Bitmex (the largest crypto futures exchange in the world) pays out every 8 hours. That sure beats bank dividends at just 4x a year!

An interest rate of 0.443% doesn’t sound like much, but multiply that by three (to get the daily return) and then by 365 (to get the yearly return).

And that’s how you come with a yearly return of 485%.

However, there is one problem that most—and I mean way over 95%–bitcoin investors don’t understand.

If you try to trade bitcoin while you are unhedged, you are exposed to the crazy price swings of Ethereum (and Bitcoin).

But what if I told you there is a way to hedge against those price swings?

Hedging means the risk goes waaaaay down. Almost to zero.

Would you be interested in learning how to do that?

Good, because I can teach you about that.

I shorted Ethereum futures on May 17th, 2019 but I didn’t worry at all about the price of Ethereum because I was hedged.

I have been using hedging techniques on my crypto portfolio for about one year now with great success.

Overall, I am up 40% if you take the value of my portfolio just in crypto.

In US (or Canadian) dollars, I am up a lot more, nearly 80%.

If that doesn’t sound impressive, remember that Bitcoin was in a bear market for more than half the time I was hedging.

Any trader can make money in a bull market, but I did in a bear market too.

My hedging techniques guarantee that I will make HUGE PROFITS over the long term, despite the volatility of cryptocurrencies.

Here is bitcoin’s historical return for the last five years:

2014 -58%

2015 35%

2016 125%

2017 1331%

2018 -75%

2019 92%

The savvy, experienced investors won’t look at 2016 and 2017.

No, they will focus on 2014 and 2018 and say “no thanks.”

I’m sure you have heard people say, “hey when you invest in bitcoin, you need to think long-term.”

That’s easy to say if you put your money during 2015,2016, or 2017.

But in 2018, I will bet investors new to crypto couldn’t stop thinking about the short-term, as they lost up to 80% of their investment.

The problem with crypto is volatility. It will shatter your nerves and break you.

But hedging puts a stop to that.

Investment Systems Don’t Work. Except When They Do

There are two immediate benefits to hedging with crypto.

One, you get to sleep at night. This is a big benefit!

Two, your investment returns will greater than if you just bought and held. I guarantee this.

How do I guarantee this?

I’m going to prove it to you, Mathematically. Right now.

Proof that Investing Returns Will be Greater

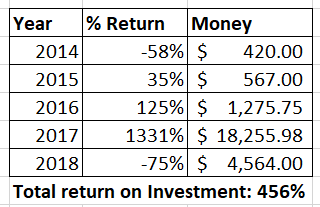

Let’s assume we invested $1000 in bitcoin at the beginning of 2014 (a very bad year).

At the end of five years, you have made a 456% return on investment which is AWESOME.

I mean it sounds fabulous until you think bitcoin was a VERY high-risk investment during those five years and there were a couple of years in there that would have tested the nerves of any investor.

However, I want you to look at this chart:

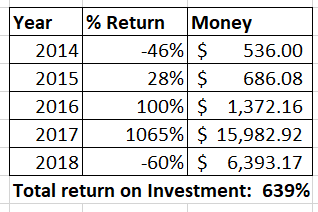

This is the return on bitcoin for the last four years – with volatility reduced by 20%.

If the year is a loss, then your losses have been reduced by 20%.

Conversely, if bitcoin was up that year, your gains were reduced by 20%.

Reducing volatility turbocharges your investment return.

This isn’t something that I just made up. This is one of the great investments tenets that was discovered back in 1951, known as “market portfolio theory”, or MPT.

To give a VERY short summary of market portfolio theory (and my apologies to financial analysts who probably know this theory chapter and verse) there are two main points:

1. With a greater return on investment, there is always greater risk (i.e. volatility).

2. Diversification of your risky investments allows for greater return as it reduces volatility.

MPT has been called the greatest free lunch of investing.

Now, how does MPT apply to invest in bitcoin?

We can’t diversify. But we don’t have to. What we need to do is mimic the effect of diversification. We need to reduce volatility, to reduce risk, to really make our investing in bitcoin better than market return.

Key questions: Are there financial instruments that allow us that?

Answer: Yes. And I’m going to tell you about them.

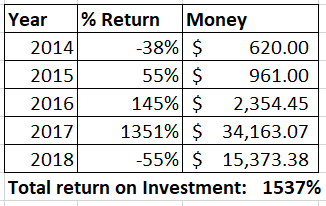

But first, I want you to look at one last spreadsheet.

Fifteen times your money, investing in bitcoin, in five years, with two of those years being vicious bear markets.

How is that?

You should notice that I assumed that every year we made an extra 20% on our return in bitcoin – even in a down year.

That sent our investment return soaring to the stratosphere.

Key question: Are there financial instruments in the world of crypto that allow you to do that.

Answer: Yes. And I can show them to you.

Cryptocurrency Derivatives that Allow You to Bet Big….But Also to HEDGE

What is hedging? Simply put, it’s the practice of borrowing bitcoin cheaply, with leverage in one market and loaning out at a higher interest in another market.

How is this possible?

Well in the bitcoin universe, there are not only investors who buy bitcoin, but gamblers as well.

Gamblers don’t just buy bitcoin; they buy bitcoin future contracts. They place bets on whether the price of bitcoin will go up or down.

The market needs SOMEBODY to cover the other side of that bet.

When the market is bullish, somebody needs to SELL those bitcoin futures to gamblers. And when the market is bearish, somebody needs to BUY those bitcoin futures.

And that somebody is me (and can be you).

But I don’t cover off the bets of gamblers for free. The house (that’s me) always get a cut. And you can too.

This practice of hedging in financial markets has been going on for centuries. So, of course, there are financial instruments designed in the crypto world specifically for hedging.

Year over year I am tracking to make 50% annual return on my hedges. I have made a 40% return so far.

I will show you how to set up this trade. Another big plus on this trade? I only tweak it a couple of times a week. I spend 15 minutes a week looking at this trade.

In my 30 year investing career, I have never found a safer or more lucrative trade. And here they both are, all in one trade.

This is the Pitch

I have been with this trade since June 2018. As each day passes and I am more confident in this trade, I add more dollars. I now have over 50% of my investment portfolio in this one trade.

There are very few investors out there who are using these hedging techniques. They are the minnows who use trading signals to try to trade bitcoin—and they get eaten by the bitcoin whales who hedge.

Initially, I’m only accepting 100 subscribers—because there is a good chance I have to spend time with you one-on-one to educate you on how to set up and manage this trade.

I have written ten of thousands of words on hedging in cryptocurrency. It’s all original material.

I have recorded hours of videos on hedging and what you need to know about the financial instruments in cryptocurrency that allow you to hedge.

I have assumed you know very little about bitcoin. My course will take you from novice to expert-level trading.

Plus, every step of the way, I will show documented proof – the historical record- that hedging WORKS IN ALL KINDS OF MARKETS.

That is key. When bitcoin enters a bull market, anybody can make money. But how about when bitcoin undergoes one of its usual corrections? Not so much then.

I promise you can make a fortune and then keep it too.

I’m going to keep this a small newsletter, as many of you will need some personal attention. This isn’t your usual service where some newsletter writer throws out a stock pick and you phone up your broker and away you go.

I’m committed to making this trade work for you. And make the psychology around it work for you as well. There will be a learning curve, and I’ll work you through it.

What would you pay for a trade that will allow you to profit for YEARS, possibly decades—for only 15 minutes a week? And personal attention to help you remember how well this trade works even in a bear market.

Trust me at the end of the first couple of months, you will rest so easy with this trade, while your investing friends are pulling their hair out, watching the stock market or bitcoin price. Because with my trade, you don’t care about either of those.

Crypto is here to stay. Bitcoin is here to stay. It’s time to come aboard.