The Dirty Word Nobody Wants to Say

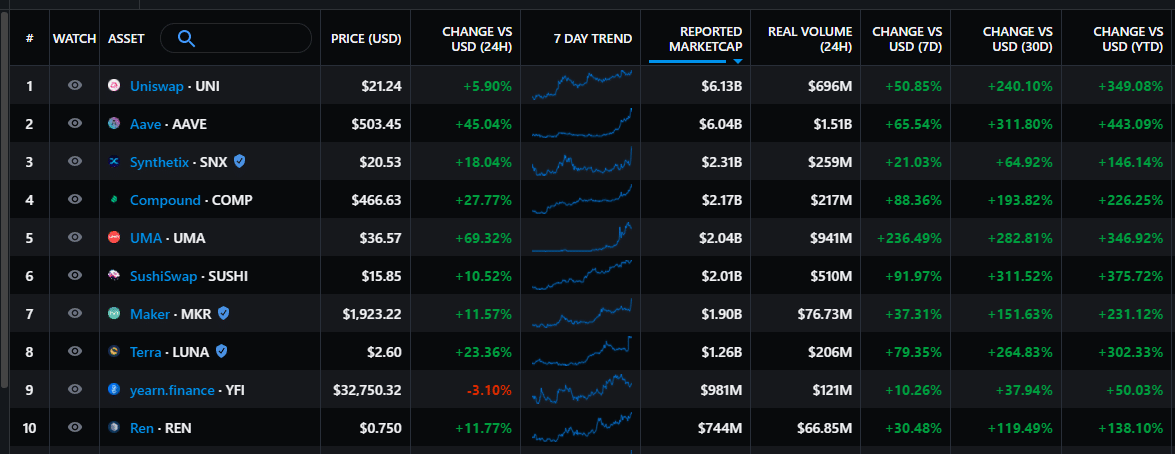

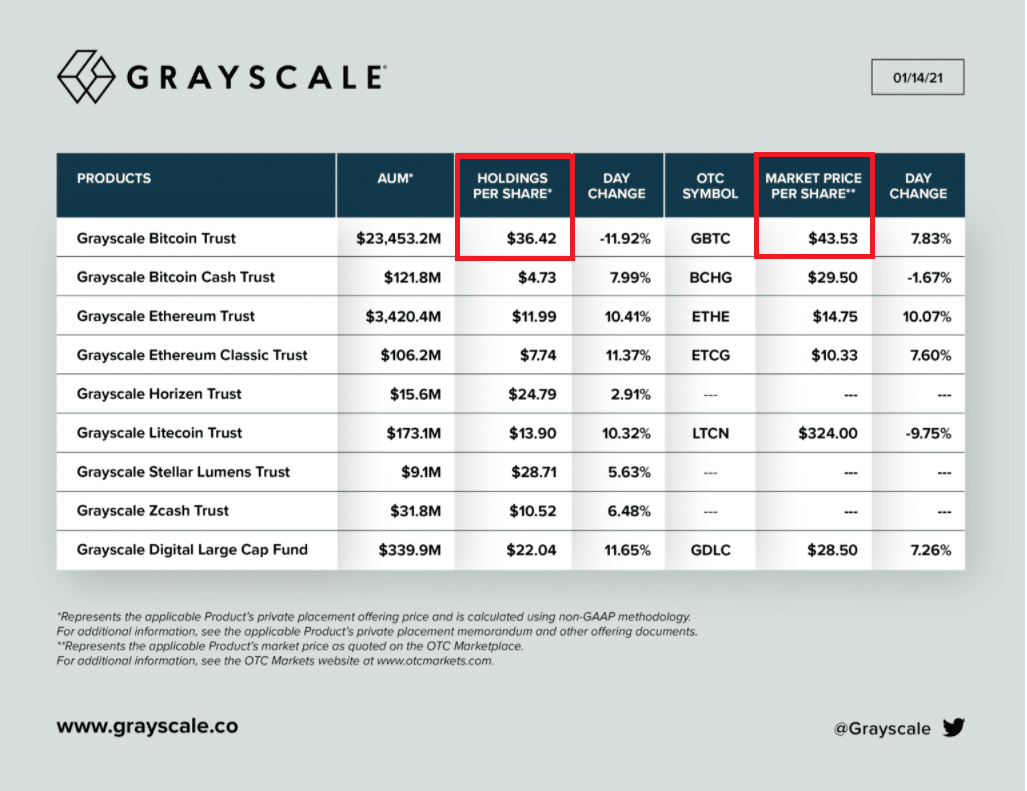

Rehypothecation : Rehypothecation is the re-use of collateral from one lending transaction to finance additional loans. It creates a type of financial derivative and can be dangerous if abused. https://www.thebalance.com/rehypothecation-investment-disaster-357232 To fully understand rehypothecation (and hypothetication), we could write a couple of thousand words on the subject. Much easier to use some examples. Remember the Gamestop fiasco? At one… Read More »