Predicting the price of bitcoin is a game for suckers but it’s hard not to be cautiously optimistic this January.

Since its spectacular swan dive down to $3200 on December 16th, bitcoin has recovered to $4000 USD, or a 25% increase in less than one month.

If it manages to stay above $3700 for January, that would be the first monthly gain for bitcoin since July.

While a 25% jump is not much to cheer after a drop of 75%, a mediocre January is somewhat bullish.

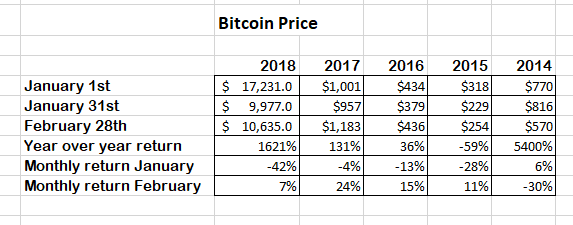

Traditionally, bitcoin goes down in January (average 16% drop) but recovers in February:

For many North American retail investors, it just made good tax sense to dump bitcoin and other crypto at the end of the year.

What’s the Big Deal Anyways?

Media coverage of crypto is vastly of out-of-proportion to it’s impact on the world financial markets.

Take the market cap of bitcoin. It’s currently near $70 billion USD. In 2017, it reached a high of $240 billion.

In less than three months, $400 billion was wiped off the market cap of Apple, going from $1.14 trillion down to $740 billion.

Even at its peak, bitcoin had a market cap only slightly bigger than Nestle, which ranks #20 on the list of biggest public companies in the world.

But now? The 100th publicly-ranked company in the world, Salesforce, has a bigger market cap than bitcoin at present ($97 billion versus $70 billion).

Despite all the hype of the last eighteen months, very few investors ever bought bitcoin. It’s still a very exotic financial instrument that is not of interest to most of the world’s wealthy elite.

For example, there are 36 million millionaires in the world, but only slightly more than 17 million bitcoins in circulation.

What Does the Future Hold?

As I said before, predicting the price of bitcoin is a mug’s game. But it’s hard to think of reasons why bitcoin should go down (even more than it has).

Perhaps the biggest surprise of 2018 for crypto was the utter lack of technological advances made by any coins or token in the crypto-space.

Bitcoin only had one upgrade of moderate significance. Ethereum had NONE.

None of the major crypto-startups delivered on any promises that were made to investors in return for equity. Bitcoin Cash in particular had a “software upgrade” or hard fork that was disastrous.

It should be a different story in 2019, as both bitcoin and Ethereum are set up to undergo major changes. I will talk about that in my next article.

DJ