On the first day of September, the US Securities and Exchange Commission (SEC) will decide whether to approve a Bitcoin spot ETF in the United States.

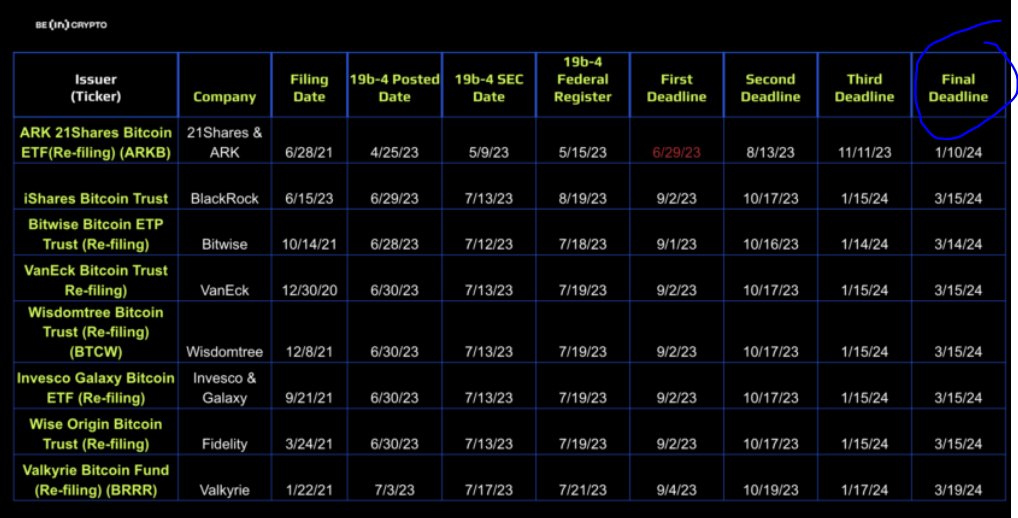

This is a calendar mapping all the Bitcoin spot ETF applications to their respective deadlines. As you can see, it’s a bit complicated.

Technically, the SEC is only reviewing the Bitwise Bitcoin ETP Refiling this Friday, but the iShares Bitcoin Trust deadline (along with five others) is Saturday so it makes sense that the SEC will make a ruling on all of them as well.

The iShares application is the BIG one, that is the ETF being proposed by Blackrock, aka the world’s biggest asset fund manager with $10 trillion USD (not a typo) of assets under management.

If an ETF gets approved, my opinion is we will see Bitcoin hit an all-time high (north of $70K) by the end of the year.

If the ETF approval is delayed, bitcoin should at best tread water but more likely sink and stagnate until October.

There is a close to zero chance that the applications will be denied.

The smart money has been saying that the SEC will delay once again (the first Bitcoin ETF application was filed 10 years ago!). But it’s no longer a slam-dunk that the smart money is right this time.

Both Bitcoin and Bitcoin mining stocks pumped Tuesday when news broke of a US appeals court rejecting the SEC’s decision to refuse Grayscale’s application to turn itself into a Bitcoin spot ETF.

That’s very good news but the future is still cloudy.

It’s not a court order that says Grayscale can now turn itself into a Bitcoin spot ETF. The ruling states that the reasons given by the SEC to deny Grayscale’s application were not sufficient.

In theory, this means that the SEC can come up with another weird reason to deny the Grayscale Bitcoin ETF application, as well as other applicants like Blackrock.

But this is the second major court defeat for the SEC when it comes to crypto (the first was the Ripple lawsuit, lost by the SEC in July, although they are appealing).

The market now thinks a US Bitcoin spot ETF is just a matter of time, with some commentators saying there’s a 75% that we will see approval of a Bitcoin spot ETF in 2023 (how they calculate that is a mystery to me, but whatever)

How far can the SEC kick the can down the road?

The SEC can delay until March 2024.

Why Is a Bitcoin Spot ETF so Important?

Why don’t people just buy Bitcoin?

I was asked that question by a crypto-developer over coffee, a few days ago. It’s a good question, as not many people (who aren’t institutional investors) have thought it through.

And the answer is, it’s easy to buy Bitcoin, but not so easy to sell it. Let me explain with an example:

Let’s say you are the sovereign country of Guacamole (BTW I love Guacamole) and you want to buy $200 million worth of Bitcoin.

You place the order through multiple exchanges to hide your intention as best you can from the frontrunners and after a week of trading through your team of brokers, you have $200 million of Bitcoin in your multi-sig wallets.

Everything is fine.

However, a few months later, there’s a financial crisis in your country and you need to sell half of your holdings. Perhaps Bitcoin has gone up 10% in that time, so you need to sell $110 million worth of Bitcoin.

You move your Bitcoin out of your wallet to the wallets of the exchanges that are selling your Bitcoin, give the marching orders to your brokers, and a week later, you have $110 million sitting in your accounts.

Now you ask the crypto exchanges (or just one, if you find one big enough to handle that kind of volume) to wire you the money.

And that’s when the trouble starts.

First of all, the crypto exchange you are dealing with needs to have a good relationship with their bank. And a lot of them don’t.

Binance, Kraken, and Bitfinex have all had serious banking issues in the past year, due in no small part to US regulators aggressively shutting down those banks that had crypto exchanges as customers (Does anybody remember Signature bank)?

Even a crypto exchange that does find a bank that will accept their business, is at risk of having ANY transaction halted and reviewed for weeks, if not months, due to KYC (Know-Your-Customer) and AML (Anti-Money Laundering) regulations that apply to any bank in the world, as long as processes US dollars.

The “risk” of selling large amounts of Bitcoin and not getting your US dollars safely in your bank account is very real.

A Bitcoin spot ETF would change all that.

Let’s say Blackrock gets their ETF approved, and lists the ETF on Nasdaq.

At a stroke, you cut the banks out of the picture, as well as those nasty KYC/AML regulations that could cause your account to be frozen.

Do you want to buy Bitcoin? Buy the ETF and Blackrock, for a very small fee, will buy the Bitcoin on your behalf. Sell the ETF, and Blackrock will again do it for you.

The money will hit your brokerage account in minutes, and after a three-day settlement period, your brokerage house will wire you the money, guaranteed.

What about Blackrock’s relationship with the banks? Blackrock is the largest investment fund in the world, with $10 trillion in assets under management.

No bank in the world is going to say no to Blackrock. Everybody will get their money.

It’s simple. No ETF, no institutional money coming into crypto, for now.

Should We Be In or Out?

Last week I was 90% in cash. Upon news of the Grayscale ruling, I went into the market. But only a little bit.

What are the chances of me ending up in the red for September? Extremely high. I’m already down about four percent.

But with the Grayscale ruling, the “risk” of there never being a spot Bitcoin ETF has been reduced dramatically. The SEC has to green light at some point in the next seven months.

But when? I have no idea. But I don’t want to be 100% in cash on the day that happens, because Bitcoin will spike, and I mean take off like a rocket.

So for now, I put a chunk in the market, and I’m sweating it out.

DJ