Governments don’t want to ban crypto. They want to control it.

Correction: If they thought banning crypto would work, they would. But it didn’t work. So now the cold war begins.

Hong Kong, New York, and London, for the last century, have been the great financial centres of the world. Which city will be the preeminent for crypto in the 21st century?

London looks to be on the outside looking in, right now. At present, New York offers nothing but a state attorney who loves to sue anybody and anything in crypto (more on that later).

And that leaves Hong Kong.

It wasn’t so long ago that China had banned crypto. But things change. Now not only is trading crypto legal in Hong Kong, but financial institutions are ” facing pressure from Hong Kong’s central bank to take on crypto exchanges as clients.

As little as two weeks ago, you would have thought the US had given up on crypto, with the SEC launching a full-scale assault on crypto exchanges doing business in the US, with lawsuits filed against Binance and Coinbase.

Gary Gensler, head of the SEC famously went on record as saying every coin and token in crypto is a security (except for Bitcoin) and the US doesn’t need another digital currency, the US dollar is good enough.

Then, Bitcoin rallied last Friday on news that Blackrock, one of the world’s largest asset managers with $9 trillion in assets, is filing for a Bitcoin ETF.

Yesterday there were rumours that Fidelity will make its own Bitcoin ETF application or buy out Grayscale, the troubled Bitcoin Trust.

Today, the news is Citadel, Fidelity, and Charles Schwab are launching a crypto exchange called EDX Markets.

In the space of less than one week, it looks like the US has pivoted 180 degrees on crypto.

But not really. The US regulatory authorities have never really been fighting a war on crypto.

They have been fighting a war for control of crypto.

Back to New York. Years ago, the attorney general of that state hauled Tether, the organization behind the Tether USDT stablecoin, into court. The case is still ongoing.

On Friday, Tether was forced to release details of their holdings. It makes for interesting reading.

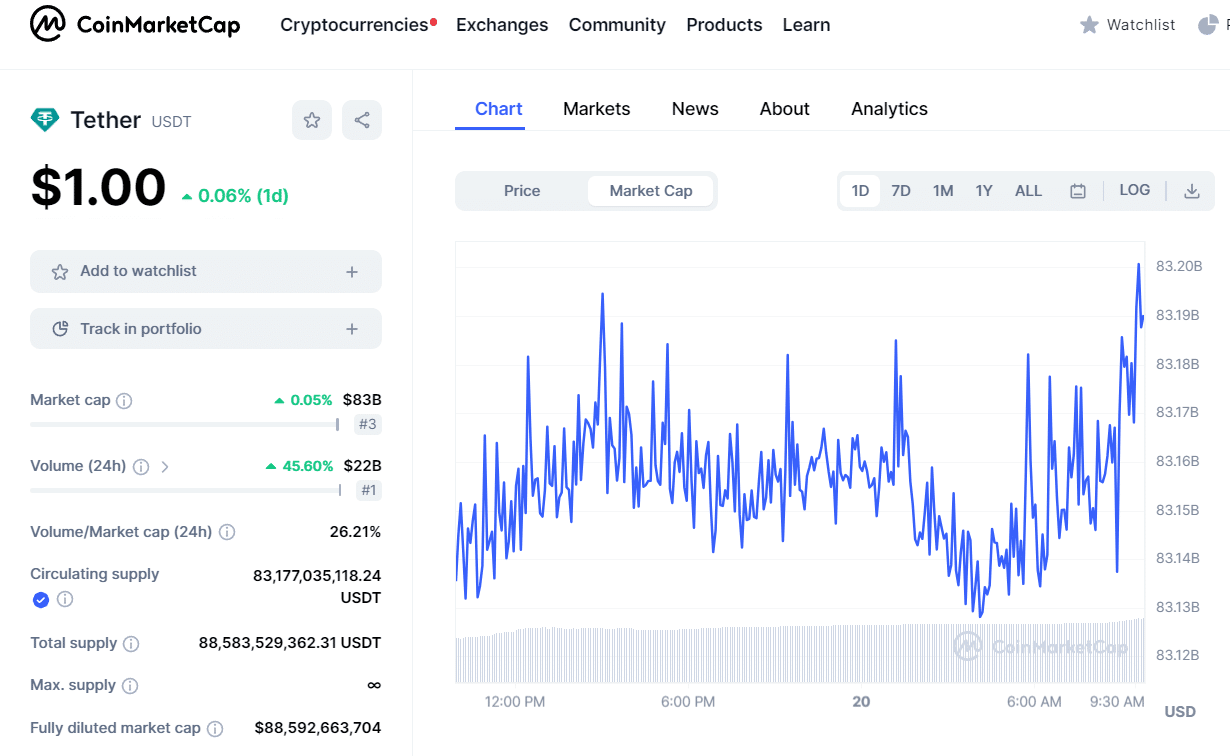

As you know, the Tether organization takes in US dollars and issues its own token in the Ethereum blockchain that is worth exactly one US dollar.

At present, they have taken in more than $83 billion USD:

It’s been investing in commercial paper all around the world, including the institutions in this list:

What’s in common with all those entities? I will give you a hint. It starts with “C.”

This is why US bank regulators grumble about crypto being a safe haven for “money launderers.”

They are not upset about drugs, porn, or guns. They see tens of billions of dollars from US investors ending up in Chinese banks, through Tether.

And the worst part (for them) is that they haven’t been able to arrest or lock up a single member of the Tether organization even though this has been going on for years.

Hence the fight against Binance, headed by a CEO who is a Chinese citizen and backed by Chinese money. The US financial authorities want Binance out of the US, and preferably out of crypto.

Of course, they have to prove that Binance has broken some US laws to do this, and that doesn’t look to be an easy task (if it was, Binance.us would have been shut down already).

What Does This Mean for the Retail Investor?

Don’t think too hard. Don’t get goofy. Why work hard researching the latest altcoin craze when every day, your favorite Bitcoin mining stock goes up in value?

Stay out of the crossfire. Binance has its own token, called the BNB token. It’s down 22%. I’m not rushing to buy it.

US financial institutions are setting themselves up to sell bitcoin (or bitcoin-backed paper) to the masses.

That’s a big hint on where to put your money right now.

DJ