COMMITTEE: “Do you see any systemic risk in the banking system because of the rapid rise of interest rates?”

POWELL: “No”

https://twitter.com/GRDecter/

By the way, if you are Canadian, don’t feel too smug. All the big Canadian bank stocks are down this month. Not as bad as the US, but let’s see how the rest of the week goes.

What About Crypto?

On Friday, with the collapse of Silicon Valley Bank, I tore into my portfolio, called my broker and started to sell, sell, sell my bitcoin mining stocks.

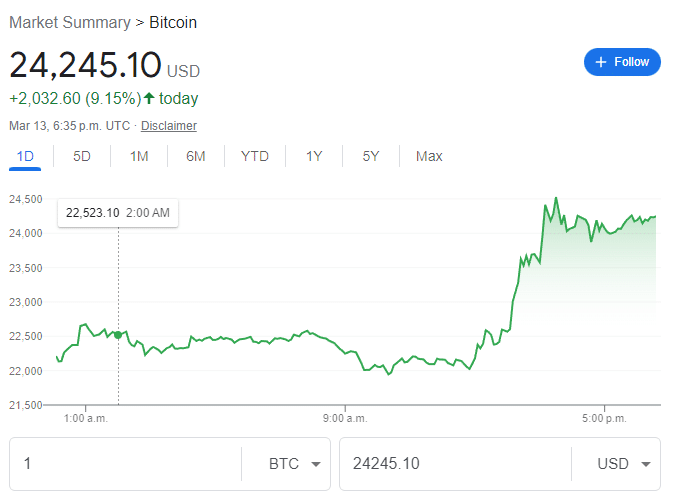

This morning, I called my broker to buy them right back.

Here’s why:

The latest sally was the shuttering of Silvergate bank more than a week because of a bank run, due in no small part to Senator Elizabeth Warren constant bad-mouthing (but to be fair, she’s had a lot of company).

Yesterday, the Fed moved to take over Signature Bank, another institution friendly to US crypto. Very quickly a lot of US cryptoexchanges have been de-banked. That’s what has been killing crypto this month.

However, last Friday, Silicon Valley Bank collapsed, a victim of yet another bank run. That too, was bad for crypto as Circle stablecoin holder (USDC) admitted that they had $3.3 billion on deposit at SVB.

Quickly one of the major stablecoins of crypto, USDC, lost its peg to the US dollar and traded as low as 85 cents Saturday.

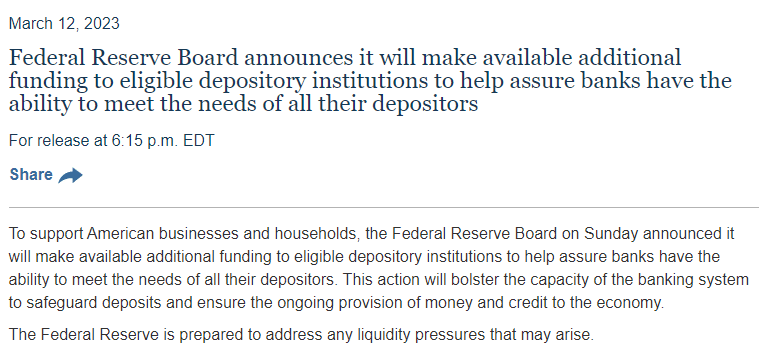

Then, on Sunday, things got weird.

In crypto-land, people were panicking. But who cares about that? You can’t go two months without panic in crypto.

But then the panic spread beyond crypto, and the Fed decided that was Not A Good Thing:

What Happens Now?

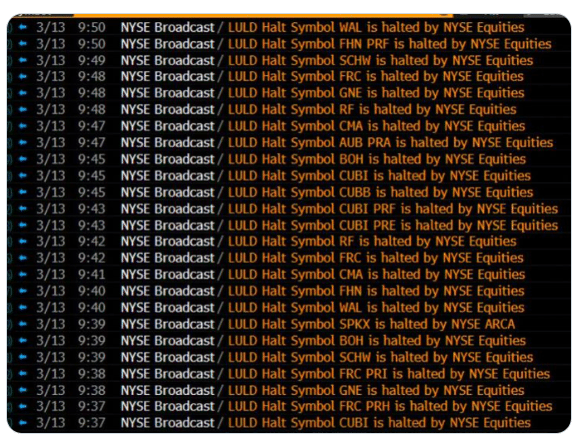

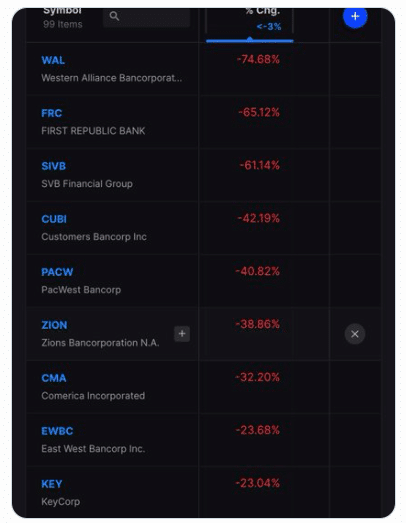

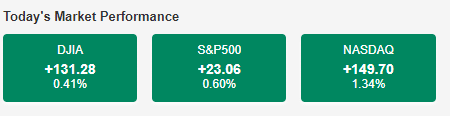

Unbelievably, the markets are taking the turmoil in the banking sector in stride:

While I have no idea how the US Fed can think it’s a good idea to keep raising rates in this type of crazy environment, I’m seeing Smart People on Twitter argue that its still going to happen.

If so, then an easy prediction to make is that everything will tank again.

Then, again, I see people arguing that the Fed needs to cut the rate to zero.

Well, good luck on that, that’s how we got into this mess in the first place.

As for me, the last week I have been selling and then buying right back and losing money on transaction fees. So don’t ask me for any financial advice.

I’m just happy I don’t own any bank stocks today.

DJ