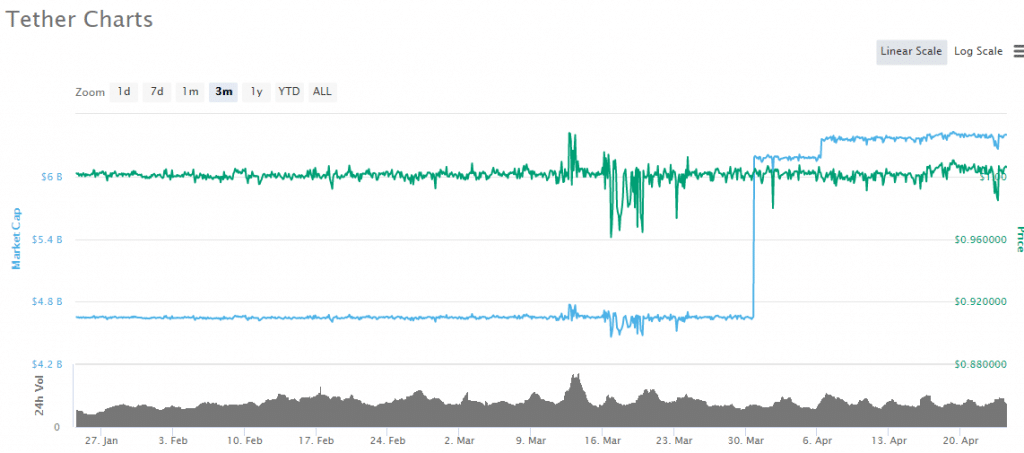

Tether’s market cap had a huge bump at the end of March, as users rushed to buy the “virtual” US dollar coin.

In case you can’t read the fine print, the market cap of Tether went from about $4.7 billion USD to a little more than $6.4 billion. One point seven billion USD was “minted” in as new Tether dollars.

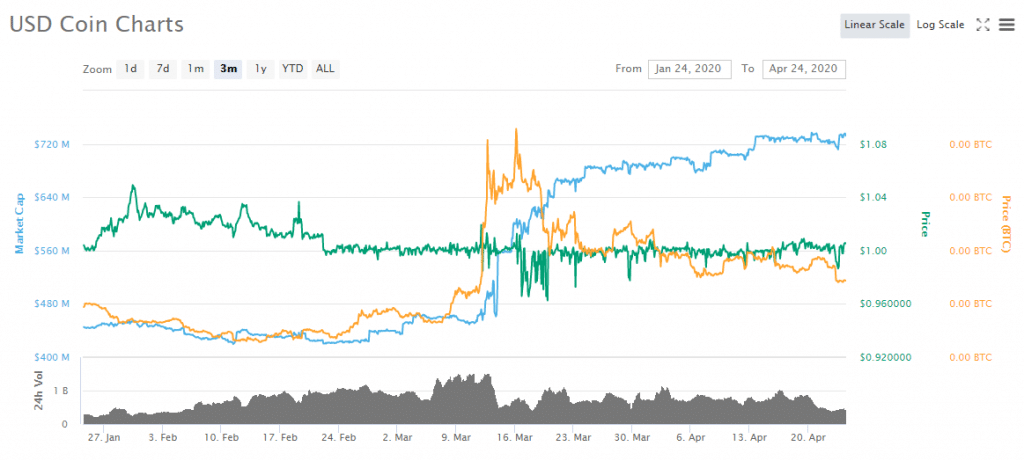

It is not just Tether. The second biggest stablecoin by market cap, USDC coin, also “minted” almost $300 million of digital US dollars in late March as well.

It now has a marketcap of more than $1 billion.

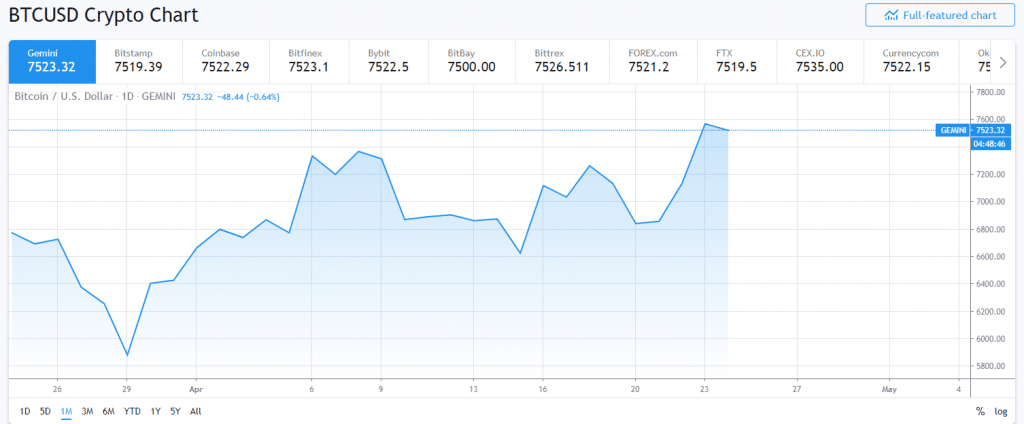

Usually when a lot of Tether is minted, you see a nice bump in the price of bitcoin.

With more than a billion new Tethers, you would expect a BIG bump in the price of bitcoin. But not this time:

By the usual volatile standards of bitcoin, this month was incredibly boring.

It’s a different story with Ethereum. It’s on a tear, up 50% from its low in March:

The influx of funds into stablecoins and the rise of Ethereum are not unrelated

Ethereum is the dominant network for virtually all stablecoins, not just Tether and USDC but also PAX, TUSD and GUSD.

Altogether these represent over more than $6 billion in assets on the Ethereum protocol.

Why do stablecoins operating on the Ethereum network boost the price of Ethereum itself? Two reasons:

1. Every transaction of a stablecoin in a smart-contract will reduce the supply of ETH and make it more scarce, as to conduct any sort of operation with the Ethereum requires to spend or “burn” some Ether.

2. Secondly, as more stablecoins issue on the Ethereum network, that will make it the ever more dominant transactional protocol of crypto (Bitcoin doesn’t allow for smart contracts), that will attract more developers and more users for Ethereum itself.

Ethereum will continue to run all this year or so. As usual, there will downs as well as ups. But the future looks bright.

DJ

Note: I am long Ethereum