The failure of Silicon Valley Bank is the second largest in US history.

The bank had US $209 billion in assets and US $175.4 billion in deposits at the time of failure, according to the FDIC.

In comparison, Lehman Brothers on Monday, September 15th, 2008, filed for Chapter 11 bankruptcy protection citing bank debt of $613 billion, $155 billion in bond debt, and assets worth $639 billion.

As of this morning, at least five US bank stocks have halted trading:

- First Republic Bank

- Silicon Valley Bank

- Western Alliance Bancorporation

- Signature Bank

- PacWest Bancorp

Silicon Valley Bank is (was) the 18th largest bank in America by assets. It is THE bank that venture capitalists and startups went to for their funding.

Here is the timeline of bank failures this week:

Wednesday – Silvergate announced it’s ceasing operations

Thursday – Silicon Valley Bank stock crashes 60% as the bank scrambles to shore up liquidity

Friday – SVB fails, taken over by FDIC.

There are two factors in this latest crisis that are most unnerving.

One is the speed of the collapse. In 72 hours, two very significant US banks have gone kaput.

That’s enough for me, I’ve been selling my Ethereum all week and today I started selling my stocks.

However, it’s the second factor that’s REALLY got me worried.

There’s a perception out there that Silvergate failed because it was indulging in flaky crypto stuff.

Likewise, perhaps the average public thinks that Silicon Valley Bank failed because of dodgy loans to high-tech startups.

Wrong on both accounts.

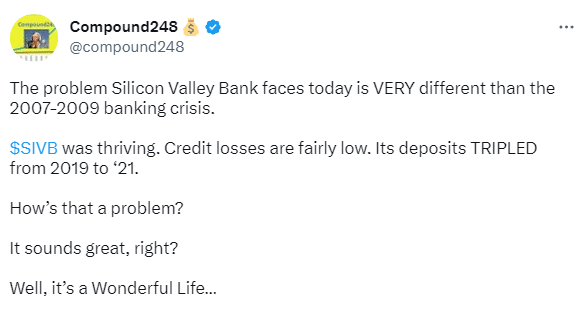

The problem with both banks is that in the last couple of years, they took in a LOT of deposits but couldn’t loan out the money fast enough.

So what did they do?

They bought LONG-TERM US Treasury bonds.

Guess what has taken over the last year (besides crypto, LOL)? That’s right, long-term US treasury bonds.

That’s the short version. A long version is in the Tweetstorm below:

Now, here is the counter-argument: One thing to keep in mind is that those institutions were investment banks, and we’re talking about commercial banks that take in deposits.

Lehman was leveraged up 30x. Banks can’t go anywhere that amount.

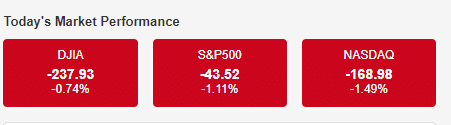

So far the stock markets are treating this event as a nothing-burger:

Well, okay, the markets are worried a little bit.

The trillion-dollar question is how many other US banks, over the last few years, took in deposits and bought long-term US treasury bonds, and have yet to report their losses?

I don’t know. Maybe nobody knows. Or the people that do know are keeping very quiet.

But because I don’t know, I’m selling.

Maybe this will sort itself out over the next two weeks. Maybe not.

I just feel more comfortable sitting on the sidelines right now.

DJ