Yesterday the US Securities Exchange Commission shut down Kraken’s staking-as-a-service product offering and this legal action will be the death of crypto, according to every article I have read so far.

This goes to show you, that the people writing about crypto today were not writing about crypto back in 2017, or even 2020.

Back then, most of the crypto-action came out of China and Hong Kong, and hoo-boy, if you think Gary Gensler, head of the SEC, is a bad, bad boy, you have no idea how things were back then.

China would “ban” crypto and shut down the exchanges, bitcoin would tank 20%-30% overnight.

Then a few weeks or months later, the exchanges would open.

All would be fine, then more rumours of crackdowns would circulate, exchanges would be shut down again, and then crypto would dump again, hard.

I just checked today and bitcoin is down 6% since Monday. Ethereum is down 7%. But we used to see bitcoin drop 6% in an hour, in the bad old days.

Okay, but what about the current crackdown?

It was inevitable.

Now, before I start, I don’t want you to think I’m a Gary Gensler fan-boy. I think his actions have been horrible for retail investors over the last few years.

The SEC turned a HUGE blind eye to FTX.

Mr. Gensler has also consistently turned down all applications for a US-based Bitcoin ETF because of ….reasons. And that decision has consigned Grayscale trust holders to an endless purgatory with their bitcoin locked up and no way to get at it.

I could go on and on.

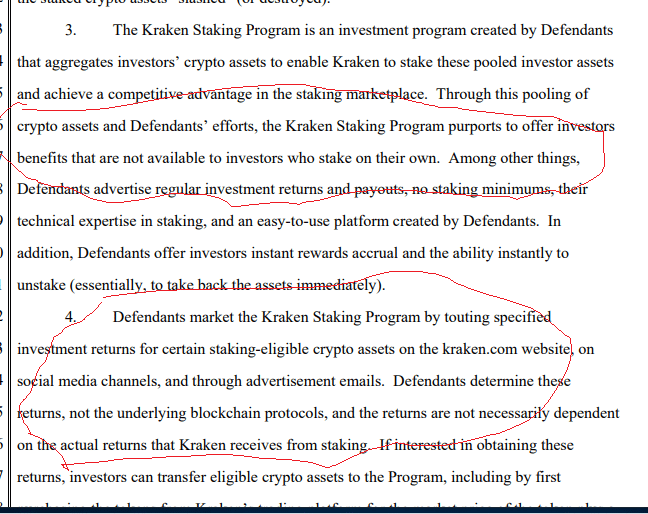

But in this matter, the SEC got it right, because if you bother to read the details, what Kraken was offering was pretty sketchy:

If you don’t want to read through the text, I will summarize it for you.

Kraken was telling retail investors to give them their money and they would stake it in Ethereum for them. And their returns would be greater than if the retail investors did it themselves.

Not only is the product offering looking a little shady, but it was also incredibly naïve of Kraken to think they could offer something like this and think the US regulators would say “Um yeah, looks fine, nothing to see here.”

Has everybody forgotten about the debacle with Celsius, BlockFi, and Voyageur, which just happened less than one year ago?

Let me refresh your memory. Those companies offered to invest retail money in crypto and offered mouth-watering returns to investors that could not get anywhere else.

You can bet the US regulators have not forgotten. I have been in the financial newsletter business since 2009, and let me offer you a bit of advice.

Government regulators may move slowly, perhaps too slowly for most of us. But they have long memories and they never forget.

If you think the regulators were going to let crypto exchanges offer opaque interest-bearing products to retail investors with a “just trust me, bro” attitude, after the debacles of 2022, then you must be new here.

But Kraken’s offering is in Ethereum staking, you say, it was legit. By shutting down Kraken’s staking service, retail investors can’t participate in the glory of Ethereum staking.

Nonsense.

If you want to invest in crypto, go ahead and invest in crypto.

But giving your money to somebody or some organization that promises to invest in crypto for you, because you don’t really understand what is going on, is just a bad, bad, idea.

That’s not my opinion, that is what the last ten years of crypto history tell anybody willing to do just a little investigating.

Own your coins, own your tokens. Don’t give your money to somebody who says they will do the heavy lifting for you. Because there is a good chance the only lifting they will do is lift your wallet from your pocket.

If you want to stake some Ethereum and get the yield from the proof-of-stake, open your Metamask wallet, get out your 32 Ethereum, and set up a staking node.

Oh, you don’t have 32 Ethereum? Fine, go buy some staked Ethereum tokens from the LDO organization or Rocketpool.

That’s too hard for you to figure out? Oh, then maybe you shouldn’t invest in staked Ethereum.

But What About the Price of Bitcoin and Ethereum?

The SEC cracking down on Kraken is causing negative price action in the short term.

There are also heavy rumours that the SEC is now going after Binance and Circle because of their US dollar stablecoins.

So does that mean crypto is going into the tank again?

That depends if you believe that what is bad for Kraken, Binance, Circle, and Coinbase is also bad for crypto, and I’m not sure I believe that.

Yes, we had a price drop yesterday. My Twitter feed is full of tweets about how the SEC is killing crypto.

But crypto exchanges since 2014 have been getting kicked in the shins by regulators on a regular basis, for good reasons, because a lot of them were sketchy and ran off with retail money on a consistent basis.

Or they got hacked because their security was sloppy.

In the long term, that hasn’t stopped the price rise of bitcoin and Ethereum.

Again, back to 2017. There was a huge regulatory crackdown from China. But bitcoin still soared more than 1500%.

If the SEC is going to drop the hammer not just on Kraken, but on Binance and Circle, well let’s get on with it and wait for the dust to settle.

I don’t think it will be as bad as everybody says it will be.

DJ