Biggest winner of the week goes to those crypto-speculators who held BONK seven days ago:

https://coinmarketcap.com/

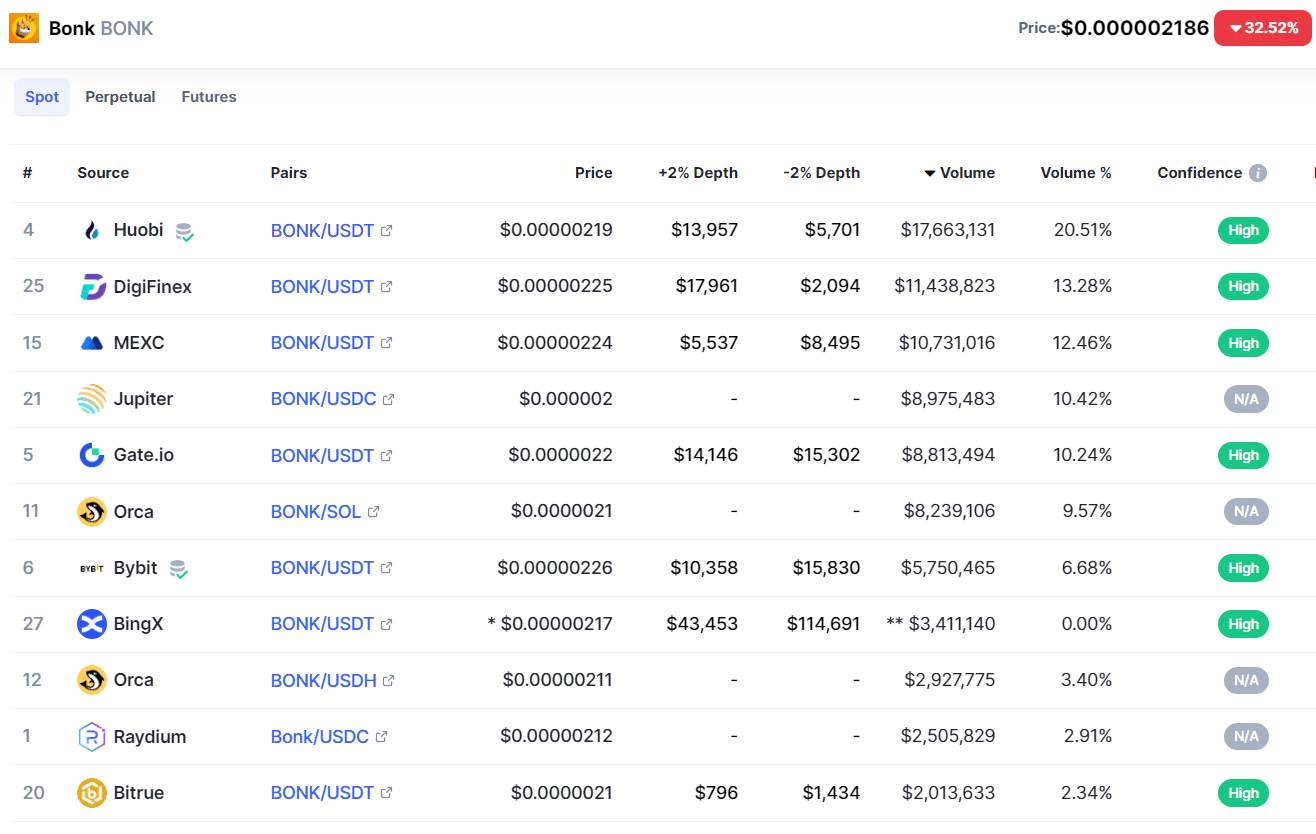

It’s hard to figure out the percentage gain because of all the zeros, but according to my calculations, each BONK was worth 0.0000001126 of a cent a week. Today it was worth 0.000001863 of a cent at the time of writing this article.

That’s a 1654% increase in one week, even after the 30% drop today.

Now the first question to ask is, who is buying this token?

And most of the activity is on second/third tier crypto-exchanges that in North America nobody has ever heard of because US residents can’t trade on those exchanges:

The second question to ask is why are people buying this pump-and-dump token (I could call it other names, but I’m trying to keep this newsletter G-rated)?

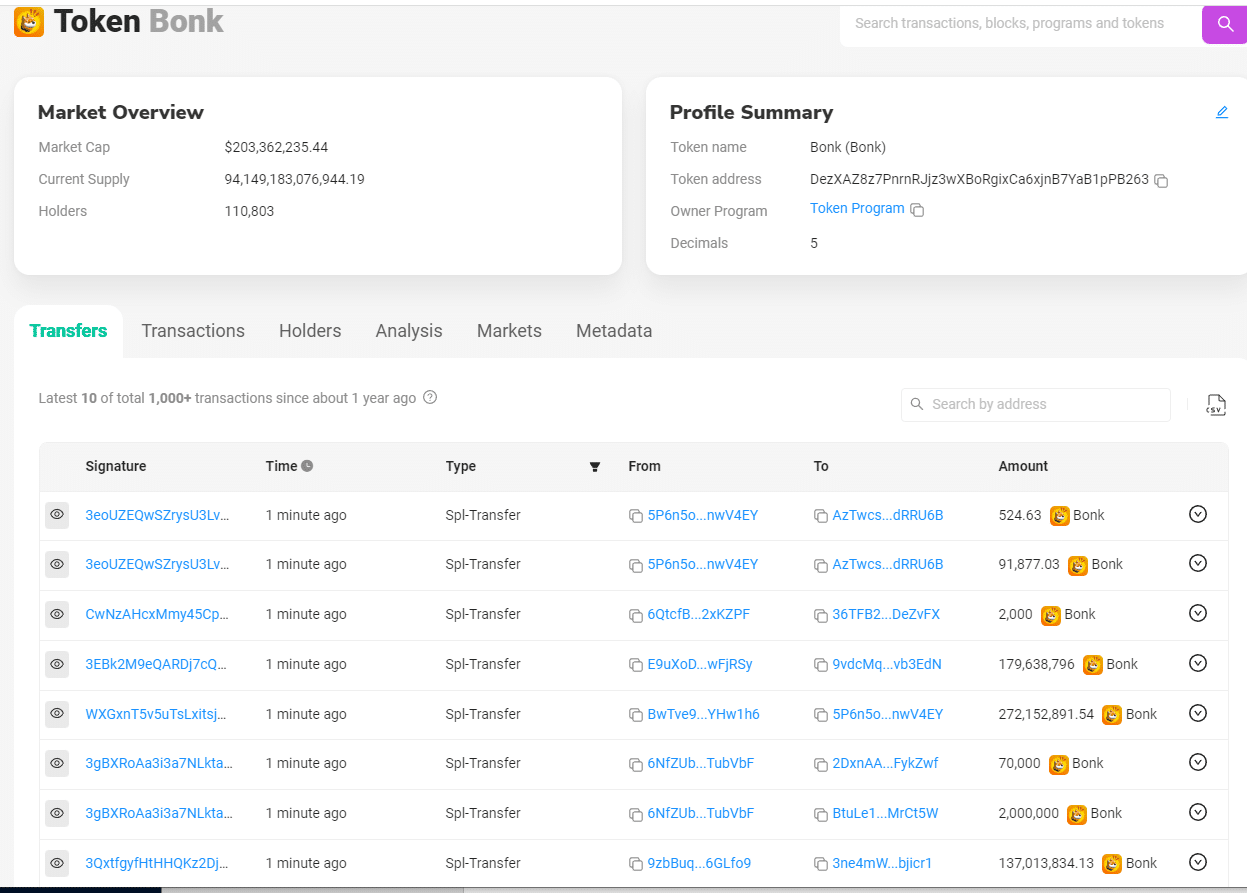

Looking at BONK transactions via the Solana blockchain gives us a huge clue:

On this page of 10 BONK transactions through the Solana blockchain, the smallest transaction was for 163 BONK, or about 0.0002 of a penny.

The largest transaction was for 272,152,891.54 BONK or $3219. But six of the ten transactions were under 2,000,000 BONK, or $2.37 cents.

(I just refreshed the block explorer page again, and 4 of the 10 latest transactions were under 2 million BONK).

The size (and volume) of the transaction tell you two things about the users.

One: These users are not investors, but gamblers (okay that’s obvious).

Two: These people are not Vegas-style gamblers, playing at the 10-dollar blackjack table. They are literally penny-ante gamblers or micro gamblers.

And they can gamble because they are sitting at one of the cheapest casinos in the world:

Each Solana transaction costs less than 0.00025 of one cent.

That means a gambler with $10 or $5, or $1 can gamble one hundred times over and still not have their “stash” eaten up by transaction costs.

Let me put it another way: How much would you pay for a cheap dopamine hit?

The advent of cheap level one blockchains like Solana and Avalanche, and the continuing improvement of level 2 blockchains like Arbitrum and Optimism mean the cost of blockchain transactions are dropping hard and fast.

In 2021, congestion on both the Ethereum and Bitcoin networks meant that transaction costs were for many weeks as high as 10 dollars or more.

The rise (and fall) of memecoins such as BONK show that the urge to speculate is alive and well in the human race, and there is a huge market for micro gambling.

Now we need to see if penny-ante blockchains lead to the rise of other applications and marketplaces besides ultra-cheap casinos and memecoins.

DJ