For ten years, the chart of bitcoin was very easy to read. A very patient investor could sit back and check the calendar as to when bitcoin would take another jump in price.

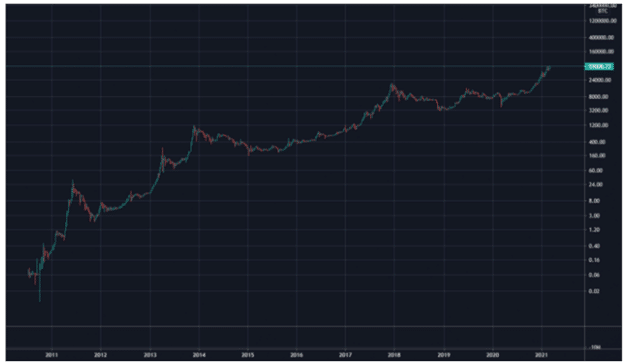

This is a logarithmic chart of the price of bitcoin since 2011. You will notice that during certain intervals, bitcoin breaks the logarithmic path and peaks somewhat, only to revert back to the mean.

These peaks are roughly correlated to bitcoin halving, which occurs roughly every four years. In 2009, 50 bitcoins were paid out to miners every ten minutes. It’s now 6.25 bitcoin.

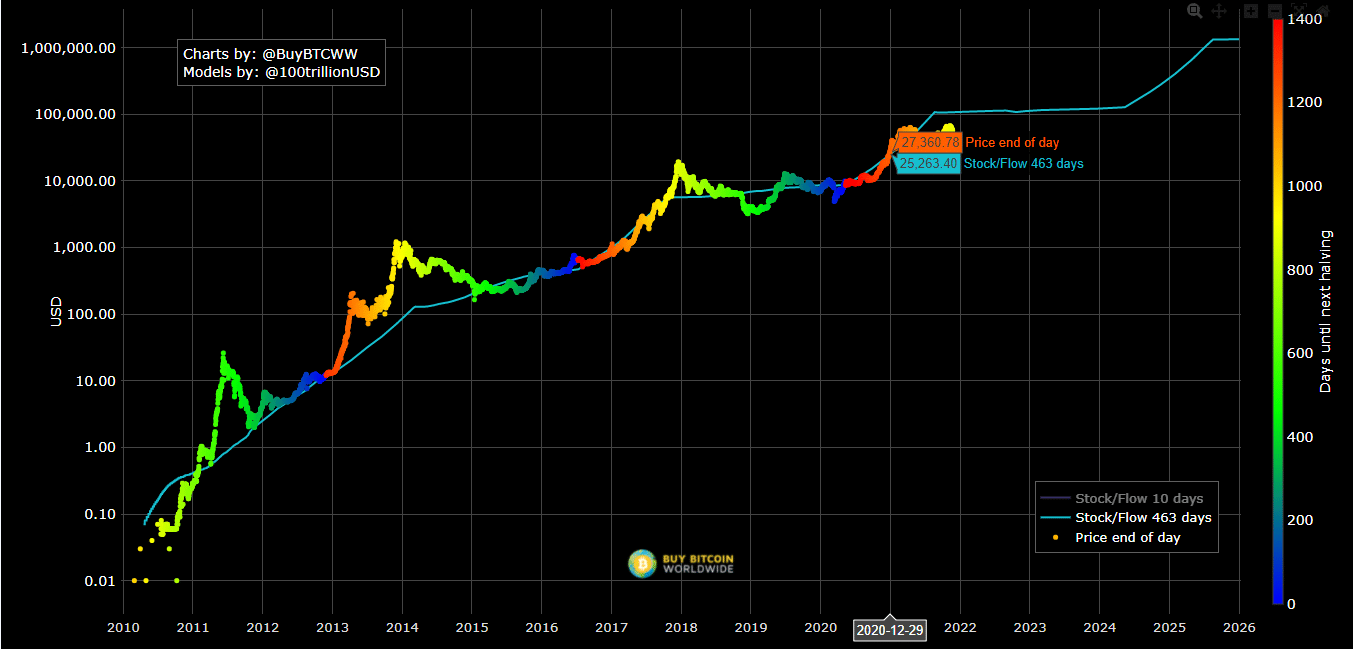

This reduction in the new supply of bitcoin has led to the creation of the stock-to-flow model.

For the patient holder of bitcoin, it’s been a glorious decade.

Unfortunately, there are signs that the model is breaking.

We should be at $100K bitcoin RIGHT NOW, even three months ago. But we are not. And it gets worse.

Not only does the model predict that the average price of bitcoin should hit $100K and stay there for at least two years, we should peak well above $100K, and do so quickly.

The model calls for $250K bitcoin in the month of December.

I don’t think that’s going to happen.

Now before I go into why I think the model is broken, I would like to say it would be wonderful if I was proven wrong in the next 30 days.

To be more specific, it would wonderful for my bank account, and my bruised ego would eventually heal.

But here are a few reasons why I think I’m right.

Firstly, all financial prediction models eventually fail when enough participants are aware of the model.

Think of this as the Observer Effect, except it’s not about physics but financial markets: “the observer effect is the disturbance of an observed system by the act of observation. This is often the result of instruments that, by necessity, alter the state of what they measure in some manner.”

Let me put it this way. For bitcoin to go to $250K, somebody must buy it at $250K (don’t worry about finding the seller at that price, I can be that guy).

But who, in their right mind, is going to buy $250K bitcoin if they are aware of the stock-to-flow model?

And a lot of people know about this model.

The twitter account, Plan B, is an account that does nothing but evangelizes the stock-to-flow model. It has 1.5 million followers.

To summarize, more and more investors are NOT buying bitcoin, they are buying rehypothecated pieces of junk paper that substitute for real bitcoin.

Exhibit A is the ProShares Bitcoin Futures ETF that debuted a few weeks back and has attracted $1.4 billion of investor money.

Did you think such an inflow of investor funds into the ETF would trigger a rise in the price of bitcoin?

Surprise! Bitcoin has gone down in price.

I have outlined the reasons why I think Bitcoin futures ETFs are toxic here in this article.

But I should have gone farther. It’s not only toxic for investors who buy the ETFs, it’s toxic for the whole market.

Gold bugs have been complaining for years that the rehypothecation of gold by the banks has led to the price of gold being kept artificially low.

Bitcoiners have long held “that can’t happen to them.” They might be in for an unpleasant surprise.

Conclusion

And that’s why I don’t hold much bitcoin in my portfolio anymore. I hold a lot of Ethereum (no surprise there) and I’m increasing my holding in other coins/tokens (something for years that I’ve resisted).

To repeat myself, I hope I’m wrong. I hope bitcoin goes to $100K by the end of December and even higher.

I used to think it would. But I don’t anymore.