It’s Ready Player One. Read the book, don’t watch the movie.

In case you don’t know the plot already, it’s about a boy who solves puzzles in an online world and wins a lot of money and gets the girl in the end.

And how is this a book about investing? Let me try to explain.

There are a lot of people looking at the world of crypto and thinking, should I go in?

But the people who are already living and prospering in the world of crypto, are looking at the metaverse (or metaverses) and thinking, should I go in?

Ready Player One was published in 2011. And in ten years this world has moved a lot closer to the world portrayed in the book.

Signs of the metaverse are showing up in my investment portfolio.

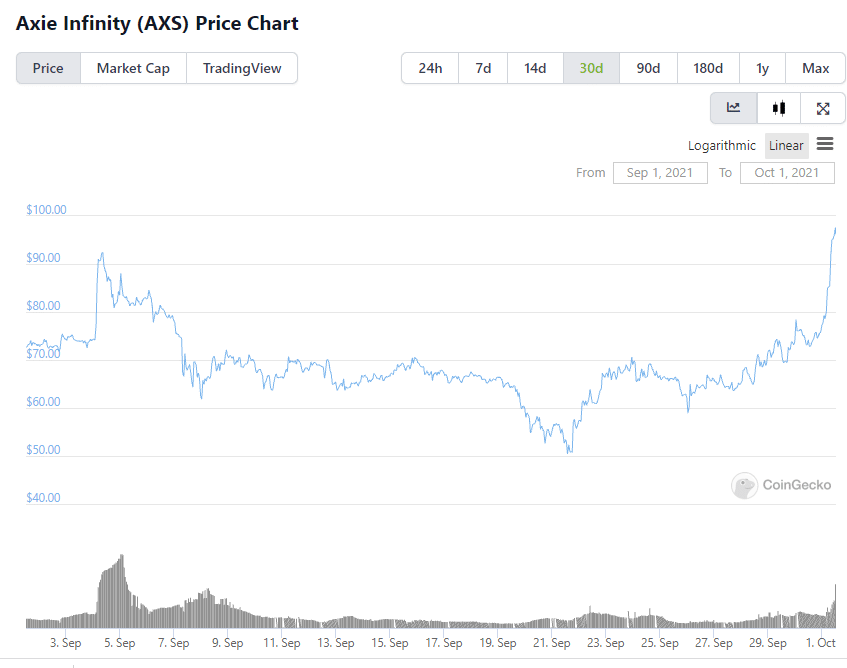

Remember September? Everything in my crypto portfolio was down for the month. Stocks, coins, and tokens. Except for one:

Axie Infinity is a game a little bit like Pokemon except players can win tokens by winning matches.

In the month of September, nearly 20 million people played the game.

To put that into comparison, nearly 10 million people watched the 2020 World Series of baseball, and 93 million watched the 2021 Super Bowl.

Let’s be honest, why are you interested in crypto? Is it because:

1) You want the world to be free of government intervention in matters of currency.

2) You are fascinated by the technical potential of public blockchains?

3) Outside of your crypto-holdings, your investment portfolio has been a flaming dumpster fire.

Don’t be ashamed to admit it’s number #3. As Arthur Hayes of Bitmex notes in his blog, it’s been tough time for investors for a very long time. Cue the depressing stats sheet.

WTI Spot Oil (Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: -95%

2008 Low to Present: -61%

Copper (Under) Over Performance vs. Fed Balance Sheet

2008 High to Present: -88%

2008 Low to Present: -11%

Case-Shiller U.S. National Home Price Index (Under) Over Performance vs. Fed Balance Sheet

2006 High to Present: -86%

2008 Low to Present: -55%

Nasdaq 100 (Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: -25%

2008 Low to Present: +225%

Taiwan Semiconductor (TSMC) (Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: +16%

2008 Low to Present: +320%

S&P 500 (Under) Over Performance vs. Fed Balance Sheet

2007 High to Present: -70%

2008 Low to Present: +37%

Gold (Under) Over Performance vs. Fed Balance Sheet

2008 High to Present: -78%

2008 Low to Present: -42%

Bitcoin (Under) Over Performance vs. Fed Balance Sheet

2008 High to Present: 24,280,396%

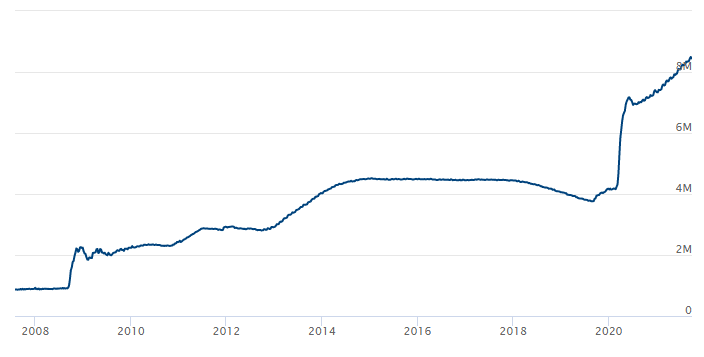

Hayes makes the argument that investors need to value investments in their relative performance to the US federal balance sheet, which as we all know, has grown enormously in the last decade:

Of course, the story today is we are finally going to have a general commodities boom and yes, some people are going to make a ton of money exploiting the shortages and snafus in the supply chain at present.

But remember the last commodities boom was driven by the relentless growth of China back in the 2000s. The current bout of commodities inflation is being caused by COVID disruptions.

How long is inflation going to last? Everybody says the system is broken, and we have inflation now and forever.

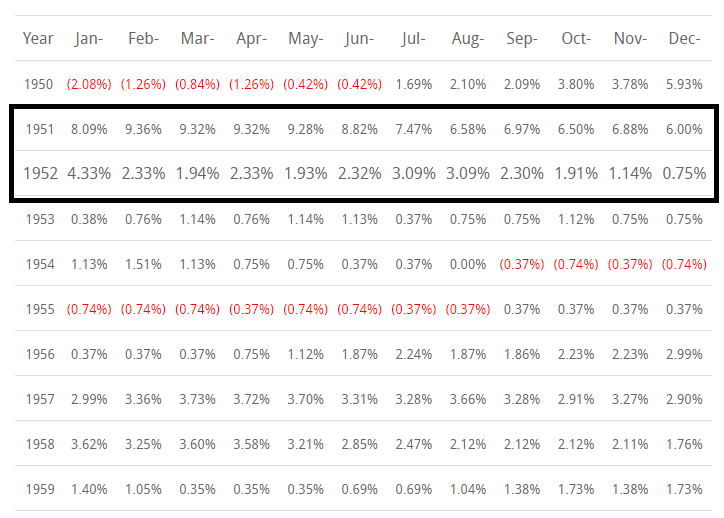

I’m not so sure. To me, this decade just looks like a repeat of the fifties:

Once the war was over, price controls were lifted and the economy had a short, sharp rise in inflation.

Does that sound familiar?

We haven’t had price controls, but COVID restrictions have had much the same effect.

So where do we go, for this decade, to get a reasonable return on our investment? The real world isn’t looking so hot to me.

We must move on to the new world. The world of metaverses.

I have been investing in the stock market since 1996 (that’s not a typo). One of my great regrets is not keeping various articles that stated opinions that turned out to be completely wrong:

The scary thing to note is that most, if not all those articles, were written by very smart people.

It’s not the dummies you have to watch out for as an investor. It’s the charismatic smart guys who decimate your portfolio, who build convincing narratives that are wrong.

As I enter my fourth decade of investing, I’m not getting any smarter, but experience gives you a better sense of pattern-recognition. And here is a pattern for you:

- 1997 – What is this thing called the Internet?

- 2000 – Google is for nerds, Yahoo will be king of the search engines

- 2001 – Microsoft is going to eat Apple

- 2003 – Amazon is going to lose money forever and going to go bankrupt

- 2006 – Oil is going to $200 and stay there

- 2007 – Housing prices are going up year after year for the next decade

- 2008 – Stock market is dead and going to stay dead.

- 2010 – This streaming idea by Netflix is weird and won’t work.

- 2014 – Bitcoin is a scam

- 2017 – Bitcoin is a scam

- 2019 – Bitcoin etc

- 2021- What is this thing called the Metaverse?

Conclusion

The herd makes you poor. Okay, I can only speak for myself. The herd makes me lose money.

It’s the weird stuff, the bets-against-conventional wisdom, that has for me been the best investment plays of the last twenty-five years.

Get there first. Try to understand what you have on the other end of the fishing line. But don’t spend too much time trying to figure it all out before putting your chips on the table.

Ignore the smart guys who don’t bother trying to understand the new new thing but write very clever article putting it down anyways.

At the very least, you should read the book.

DJ