Recently my wife and I drove to Osoyoos, the epicenter of Canada’s wine industry, for a few days of wine tastings.

I should have stayed there.

The emotional state of a long-term crypto-investor is brief periods of euphoria followed by moments of horror followed by long periods of gloom-and-doom.

Here we go, again.

At times like this, I ask myself how does anybody make any money in this sector? Then I check my holdings.

And then I ask myself, how did I make THAT much money?

To figure that out, you need to check the math.

In August 2018, after an extended period of selling, I decided to go back into crypto and buy a significant amount of bitcoin. Later, I converted some of that to Ethereum. Much later, I converted most of that to Ethereum.

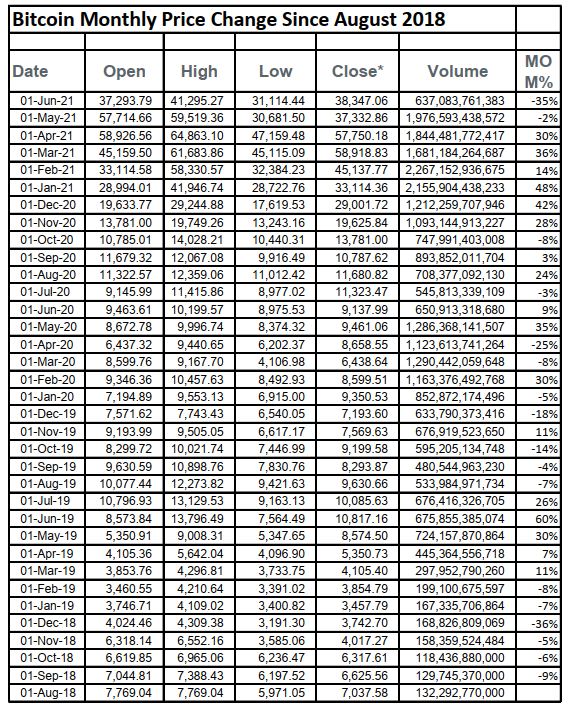

But to make things simple, let’s look at the price action of bitcoin in that time period.

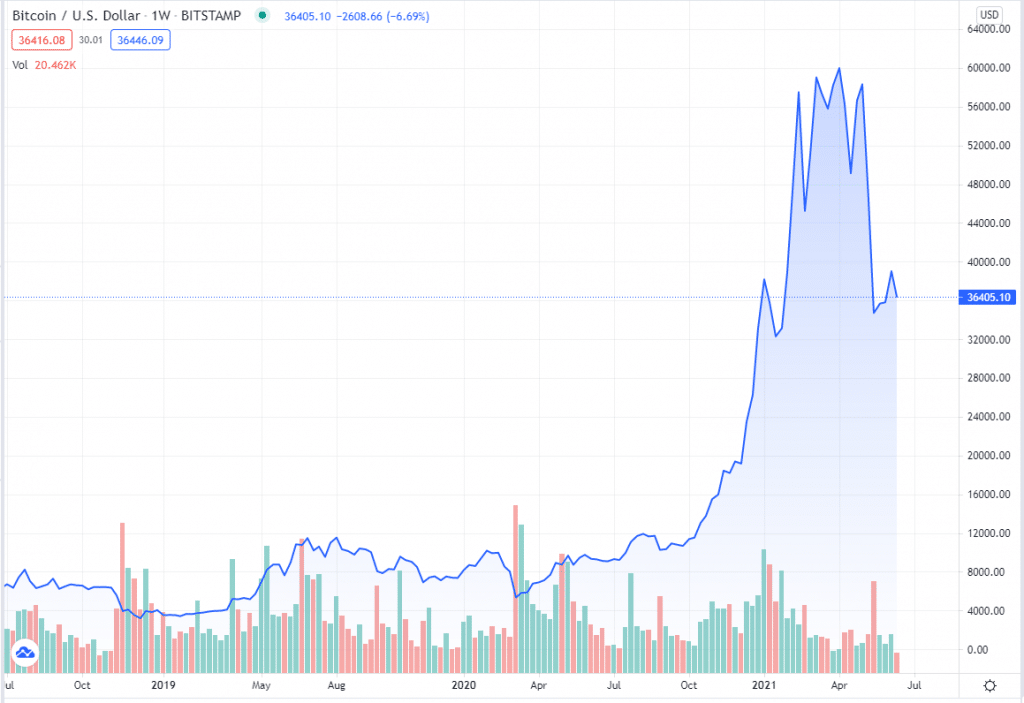

Since the beginning of August 2018, bitcoin has gone from $7215 to $36,500, an increase of about 500%.

That is less than three years. Happy times, right?

But look at the price action of bitcoin from month-to-month over the same time period:

Of the 33 months listed in that chart, bitcoin’s month-to-month price was negative SEVENTEEN TIMES or 51% of the time.

To summarize, in a period where bitcoin increased five times in value, more than half the time the price action was negative month-to-month.

In a roaring bull market, that means you are unhappy at month’s end more often than not.

But what if you checked the screen every week?

Well, if you take a sample of the 152 weeks spanning that time period, the price action was negative in 86 of those weeks, or 56% of the time.

Please note I didn’t cherry-pick the dataset to prove my point. This time period excludes the first six months of 2018 when the beginning of the bear market destroyed every crypto-investors portfolio, and includes the six month period of November 2020 to March 2021 when bitcoin rose in price for a consecutive six months.

That would give you a time period when monthly returns would make any investor downright suicidal.

Again, just a reminder, why did I pick August 2018 as the beginning of this data set?

Because that’s when I plunged into crypto deep and hard, and stayed in crypto and didn’t run away at the first hint of negativity.

And I have been rewarded handsomely for this strategy.

I don’t know what this story means to you, but what it means to me is that for the next three years, I should spend less time looking at the screen and worrying, and more time in Osoyoos.

DJ