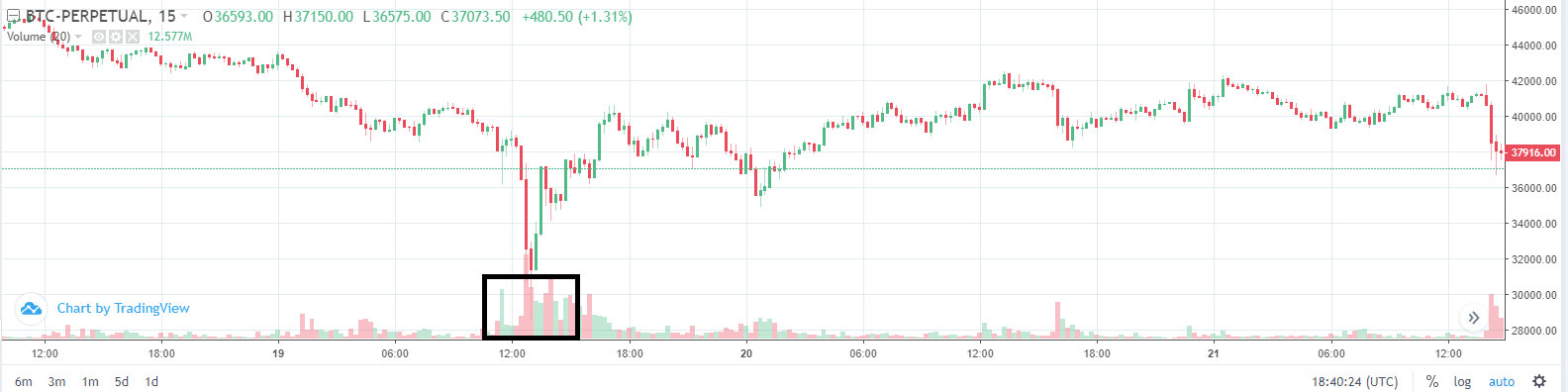

A liquidation spike, or death spike, last Wednesday, put thousands, if not tens of thousands of crypto-investors back to zero.

Only 12 hours before, bitcoin was trading at $46K, a drop of 37%.

That means every crypto-speculator who was leveraged at more than 2 to 1 had their positions wiped out.

It is estimated that $8 billion USD of bitcoin positions were liquidated.

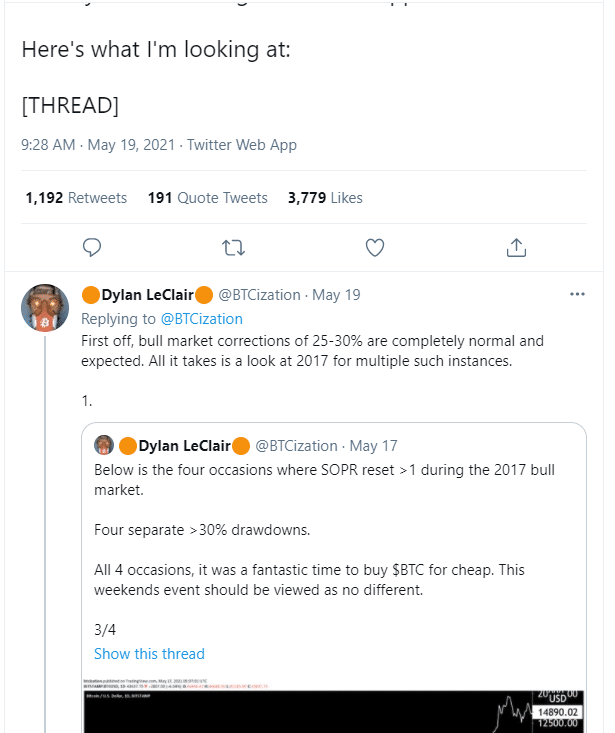

A nice summation of what happened (and why) is in this Twitter thread here:

During a fantastic bull run, some people get greedy and more importantly, careless.

The data that shows which crypto-holders are way over-leveraged can be found out or bought by those in the know.

It happens at least once a year. And the market never learns, because it happens so quickly, and the market rebounds so quickly, that people forget.

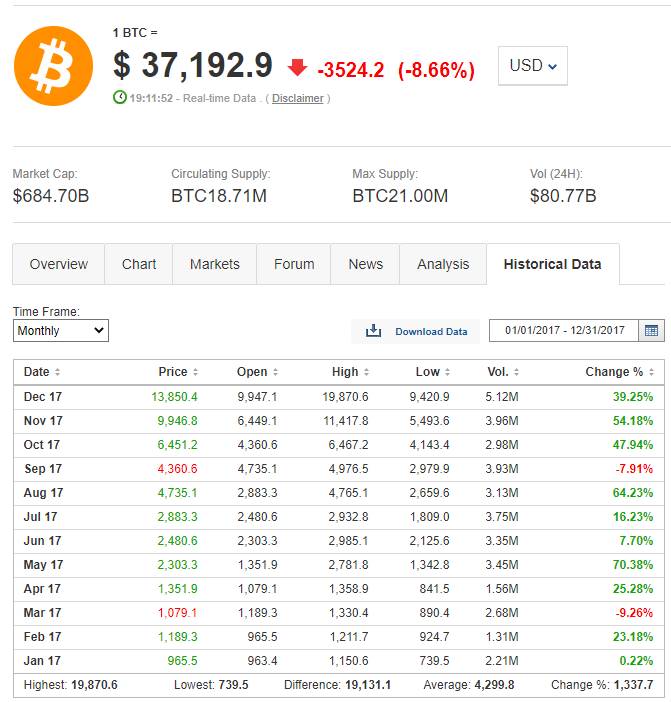

Look at the monthly historical return from 2017

In a year where there were THREE corrections of 30% or more, bitcoin never finished the month down more than 10%.

Most of the time, when bitcoin corrects 30% or more, that means the start of a new bull market. There are two notable exceptions.

In 2014, the Mt.Gox cryptoexchange hack caused the price of Bitcoin to fall by more than 50%.

In 2018, Bitcoin plunged more than 50% when rumours swept the market that Bitfinex was going to go bankrupt as it’s shady banking partner ran off with more than $800 million USD.

Obviously, in both cases, the price of bitcoin recovered but it took a long time.

So what’s happening right now?

To me, it looks like a pause in the bull run while the “pigs get slaughtered.”

If the price of bitcoin holds steady over the weekend, then it all looks good to me.

DJ