(This is part II of a story I ran last week, on the Canadian Stock Exchange).

I’m getting a lot of investor decks to read on crypto companies looking to go public.

One came through yesterday morning with a market cap of under $30 million. A crypto project that has been around for more than three years.

The product has launched. It has its own coin. It’s not vapourware. Solid.

They are doing a private financing (they ALL are) and I didn’t get any of that. But I bought some stock on the open market (up 5% already)

I did manage to get $10K of a private deal with some guys out of Toronto. They too have a product that has launched. Pretty rough around the edges, but’s a real business.

I only got this financing because I knew a guy who knew a guy. ALL these financings are over-subscribed. The market is not just hot, it is incandescent.

I see guys doing $10 million raises and they have nothing but a pretty PowerPoint slide and their good looks.

Are a lot of these deals a bit fluffy? Sure. But any pullback over the next six months is just a gut-check to make the weak hands fold. That’s my opinion. Let’s roll baby.

I am sure some of you at least are curious about what stock I bought (the private financing deal is months away from being listed).

But there is a problem. The company is only listed on the Canadian Stock Exchange. That means most of you can’t buy it.

And when I say most of you, I mean Americans.

There are no US brokerages that cater to the average retail investor who wants to buy stocks that are only listed on the CSE.

“What I’m finding from a lot of people with COC kind of security that are from the US, a lot of them have bought into private placements and deals and it could be a crypto deal and it could be a cannabis deal. In general, marijuana stock or crypto. Their issue is that they have trouble actually depositing these certs to the US brokerage firm.” Says Dan Robinson, a broker at PI Financial.

“It doesn’t matter if it’s TD Waterhouse or whatever. It is maybe more difficult with cannabis than the crypto and one of the things I respect with US brokerage houses, is they are buy American, do American. They don’t really support anybody doing business outside of the United States, so they’re not cooperative or helpful in any way.” Dan notes.

How about a US investor dealing with a Canadian brokerage? You MIGHT have some luck there.

Haywood Securities has a US division. So does Royal Bank of Canada and Toronto-Dominion.

But before a broker can even think about doing business with you, he or she HAS to be licensed in the US state where you reside.

Meaning if you live in California, you MIGHT have a chance. New York, sure, good chance.

Do you live in the state of Iowa? Not so much.

There is simply not a plentiful supply of Canadian brokers who have renewed their annual certification with the various US state financial regulators.

Especially not for the average retail investors. Don’t even bother phoning a Canadian brokerage house unless you can deposit six or seven figs into an account.

Why Should Investors Care?

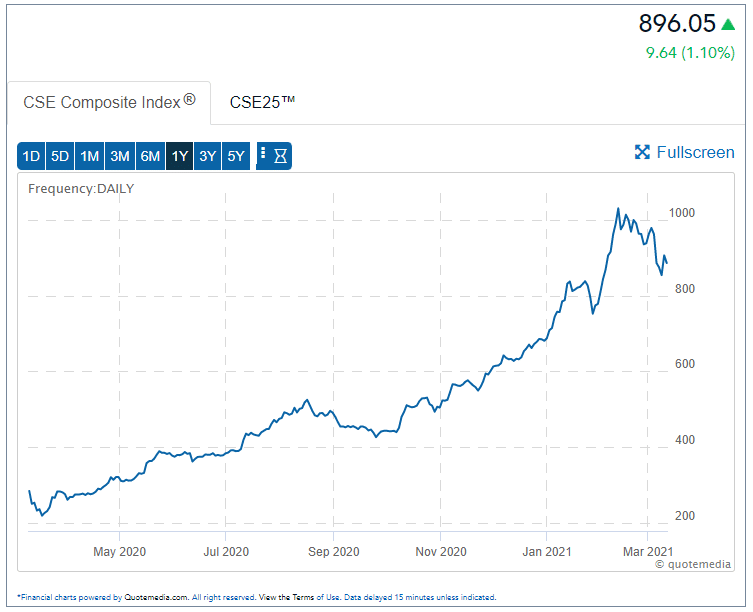

As I noted in last week’s article, Voyager Digital (VYGR-CSE) went from $2 to $20 CAD in three months. BIGG Digital Assets (BIGG-CSE, BBKCF-OTCQX) went from 5 centst to $2.00 in one year.

Of course, we don’t know if the crypto boom is going to end next month, in three months or at the end of the year.

Don’t look to me for a definitive answer. I made 300% on my public crypto-stock in the last two months of 2020, and then I sold most of them off.

Now I’m going back in, via financings or even buying on the open market.

I see a LOT of crypto plays going public in 2021.

And they are going public FIRST on the CSE, because it has the easiest listing requirements.

What can you do if you are American?

If you are an accredited investor, you can try very hard to get in on the private financings of these deals, and then hold to the certificates until the company gets an OTC or pink sheet listing.

If you are retail, watch the financings very closely, check the newswire or SEDAR for announcements about financings on companies that are blockchain or crypto-focused.

The stock from a financing usually comes free-trading four months after the financing closes.

In four months, the company will usually try to accomplish two things:

1. Get a pink sheet or OTC listing (in which you can buy)

2. Get an IR campaign running to boost the stock price by the time the financings come free-trading.

With a little bit of effort, you too can participate in the crypto-stock boom.

DJ