Rehypothecation is the re-use of collateral from one lending transaction to finance additional loans. It creates a type of financial derivative and can be dangerous if abused.

https://www.thebalance.com/

To fully understand rehypothecation (and hypothetication), we could write a couple of thousand words on the subject.

Much easier to use some examples.

Remember the Gamestop fiasco? At one point short interest was more than 100%. How is that possible?

Again, it’s complicated, and Motley Fool has a nice explanation here.

But Jack then does the same thing as Bob, lends out the shares to Jimmy who then SELLS them, hoping to buy back later at a cheaper price.

That is one way rehypothecation can grow out of a control.

Mind you, it’s more profitable just to indulge in naked short-selling i.e. without the hassle of actually borrowing the shares to begin with.

There have been rumours that brokerages houses, due to gaps in the trading systems, have been indulging in naked short selling for years.

Take for example, silver. Earlier this year you couldn’t buy physical silver for love or money. Bars? Nope. Silver coins? Nada.

So the price of silver must have gone up, right?

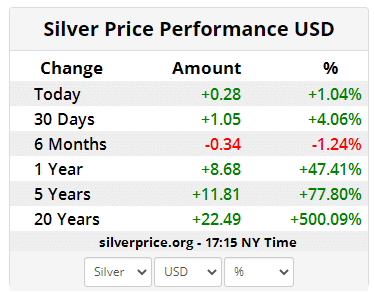

That’s not really impressive, is it? It hasn’t gone up in six months.

It’s not even a question really of whether there is rehypothecation happening in the silver market. The question is when (if ever) the rehypothecation bubble will burst.

But What About Crypto? What About Blockchain?

It’s much harder to rehypothecate with a cryptocurrency that is run on a public blockchain.

Or I should say, it’s harder to rehypothecate in a fraudulent fashion.

I will keep it simple. Take for example, bitcoin. You can create a “synthetic” bitcoin or a bitcoin derivative without the physical backing of actual bitcoin.

But unless your call or put option, or short selling is covered by a long contract or an opposing contract, you are gonna get called out by the market VERY quickly.

Nobody is going to believe your synthetic bitcoin is backed by an actual bitcoin unless you publish your wallet address and verify transactions.

Bitmex, Deribit, Binance, all of these derivative exchanges rehypothecate bitcoin (and Ethereum) many times over, but the contracts are always “covered.” And they are watched VERY carefully by their largest customers.

It’s interesting to note how much care customers will take in understanding the system if there are no regulators to back them up with regard to counterparty risk.

Finally, the crypto derivative trading houses have enormous insurance funds to cover any black swan events (like system outages). Bitmex itself has an insurance fund of more than 37 THOUSAND bitcoin, or $1.85 billion USD.

Contrast that with the saga of Robin Hood, which had to shut down the trading of Gamestop and other shares when the short squeeze got a little too crazy.

Conclusion

Thanks for making it this far. Rehypothecation is not exactly the hottest investing topic of the week, especially when bitcoin just surpassed $1 trillion in market cap.

So why did I choose to write about ii?

Because I have a bit of money in gold stocks, and they are going nowhere because the price of gold is going down.

Because I have a moderate amount of money in silver stocks, and silver stocks are not moving.

Because I have a LOT of money in crypto. Common sense says I should SELL and buy these other assets, which look to be extremely undervalued.

But the word rehypothecation keeps popping up in my mind.

And I stay in crypto.