An academic study on loan sharking in Asia discovered the average annual interest rate charged to customers is 416% a year.

But this week, crypto has that beat with some contract briefly paying out 670% per annum:

The 670% is a ridiculous number and shows a lot of “investors” shouldn’t be playing with derivatives.

Let’s take an example. You go short 100 Ethereum and the price of Ethereum doubles in six months.

Therefore, you have double the amount of Ethereum. And of course the value of Ethereum has doubled, so therefore in dollar terms, you have made triple your money.

Therefore, even in a bull market, with those type of funding rates, it makes sense to short the market.

(Full disclosure. US residents are not allowed to trade in Bitmex. In Canada, residents of Ontario and Quebec are not allowed to trade on Bitmex. But I live in the province of British Columbia, and yes I am short this contract).

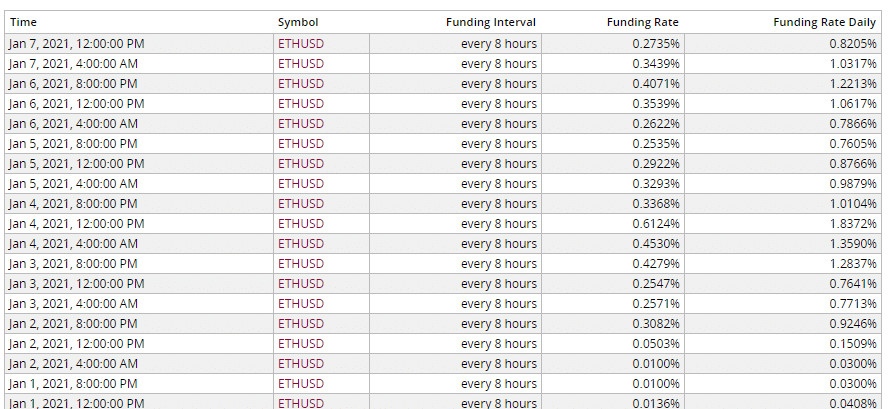

Now of course, this stupendous funding rate only lasted for one eight-hour session. However, the rates have stayed obscenely high all week:

(Note, in the boom time of late 2017, Bitmex, nor anyone else, offered perpetual futures contracts on Ethereum. Even for Bitmex, it was considered too risky at the time).

There is really nothing to compare to this bull run.

Looking back, the great spike in crypto happened because the crypto-exchanges melted down due to unprecedented volume, and the crypto market seized up (I wrote that up in my 2017 Christmas story You Want Bitcoin? You Can’t Have Any).

Today the crypto-exchanges are more robust and liquid by an order of magnitude.

This means EVERYBODY gets to profit (for now). New money coming gets to watch the price of bitcoin and Ethereum go up daily.

And long-term traders are happy to loan out their crypto to the gamblers who are shooting for the stars.

Of course in the long run, gamblers who hope Lady Luck will beat Old Man Percentage always lose.

During a correction, the over-leveraged longs will get liquidated, as usual.

But traders who short this market are guaranteed to get paid no matter what happens.

DJ