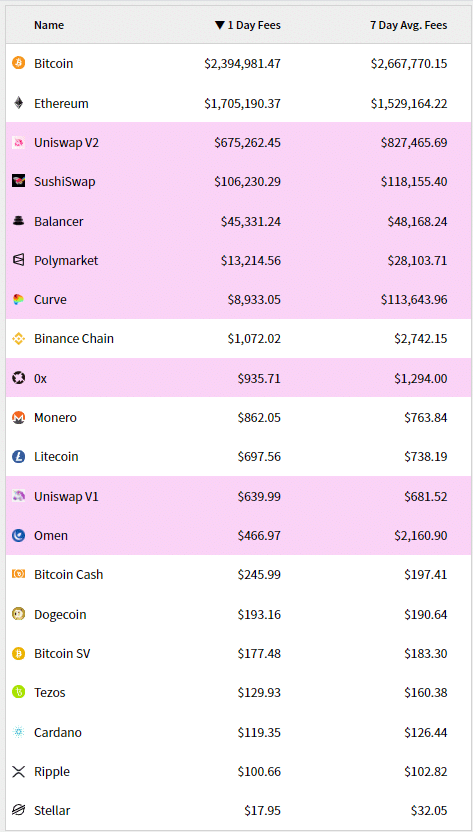

This has been my favourite chart to check almost every day for the last few weeks:

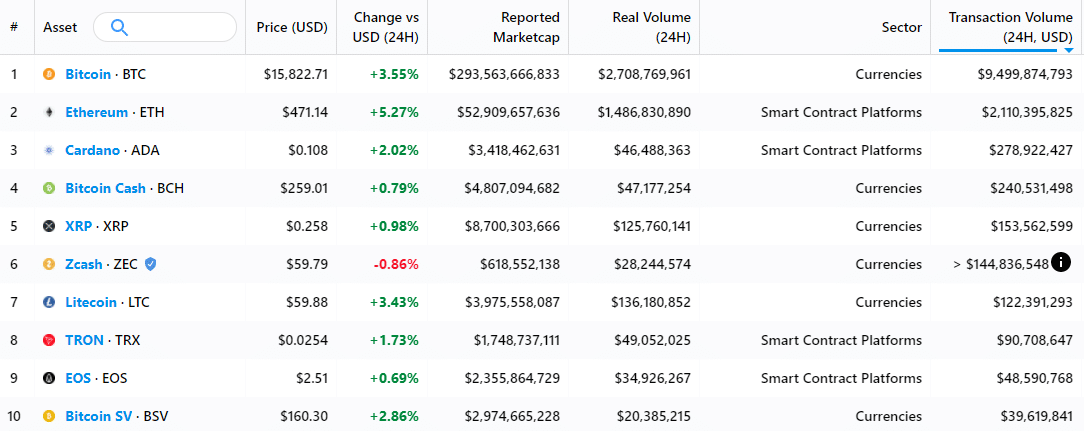

It has a market of more than $3 billion USD. Supposedly, the :”real” daily transaction volume was $46 million.

Fees generated from that transaction volume? One hundred and nineteen dollars and thirty-five cents.

So tell me, how are Cardano developers paying the rent this month?

But let’s not pick on just Cardano. As you go down the list, it’s striking how “popular” altcoins with very large market caps don’t generate any revenue.

For any cryptocurrency, transaction volume can be easily faked by using such tricks as “wash-trading.”

Market cap can be pumped up by locking up coins creating artificial scarcity.

But transaction fees? Where people actually use real money? Not so easy.

An argument can be made that high transaction fees are not what people look for when they want to use a coin for transactions. That doesn’t really resonate with me as an investor.

If somebody is paying $5 in gas fees to execute a contract on the Ethereum network but it only costs 10 cents to transfer some lumens on the stellar network, what does that tell you about the true market value of the respective networks?

It’s been three years since the great bubble of 2017. Most of these coins have been around since then and even before (Litecoin has been around since 2013).

When I first became interested in crypto in 2013., nothing was generating “revenue” (except for bitcoin).

But it’s 2020 (SEVEN YEARS) now and my patience is running thin with coins that offer “great promise.”

If the coin( token, protocol, whatever,) has a BILLION-dollar market cap but doesn’t generate fees, I don’t really care about it at all, let alone invest in it.

DJ