For the last ten years, I have invested in junior gold exploration stocks, oil and natural gas stocks, and cryptocurrency.

Oil and gas gave good returns for the first part of the decade, but for the last five years it’s been a rough go, even before the pandemic.

Meanwhile Tesla’s stock price has gone from…. Never mind, let’s not talk about that.

It’s been a little more than a year since I started investing significantly in gold exploration stocks and that has gone FANTASTICALLY well.

Cross fingers that round two of the great gold boom starts after the next presidential election.

But ti’s been crypto has been my steadiest source of investment returns since I first learned about bitcoin seven years go.

Made a nice chunk in the boom of 2014. Made a mint in 2017.

In 2018, after the bubble broke, I thought it would be smart to at least track my portfolio gains.

Just in bitcoin, over the last three years, I have made a return of 175% holding and buying and hedging bitcoin on overseas derivatives exchanges which are no longer accessible to North American investors.

During that time period, bitcoin has risen from $7500 to nearly $12000, an increase of only 60%.

Hedging is the most boring investment strategy ever created but it works.

And boring is good when you get older and you have teenagers in the house who provide you with all the stress you need and then some, thank you very much.

Three years ago, I wrote a series of essays on crypto for a sales promotion that never took off, mostly because it involved hedging on the Bitmex platform which is now banned mostly everywhere.

But in the act of writing the essay, I nailed down my investment strategy and that strategy has been very profitable.

And there are other places on the internet where one can hedge crypto. You just have to look.

Here is the essay from 2018:

There is Only Way to Win Playing Roulette

I have been writing about my hedged trades on the New Currency Frontier for about a year now and most readers I have talked to, say they enjoy reading them very much.

Especially the parts about making money.

But there’s one problem. Most readers are having problems understanding the concepts behind hedging and that is stopping them from investing in hedging opportunities themselves.

In this article, I will try to explain the concept of hedging as simply as possible.

Hedging is simply the art of making two bets that offset each other.

Pretend we are in a casino with a roulette wheel.

We put some chips on black and we put the same amount of chips on red.

No matter where the balls lands after a spin, we win back the money. We have hedged our bets.

That, in a nutshell, is hedging. But that example, begs a question. How do you make money from it?

Before I offer my strategies on how to “play” the roulette wheel in the land of crypto, let’s look at all the “investment” strategies for playing roulette (and boy oh boy, there are a lot of them.

The origins of the game known as ‘roulette’ are controversial. One version is that the first incarnation of the game was created by French math wizard and accomplished nerd Blaise Pascal sometime in the 17th century, while he was hard at work trying to create a perpetual motion machine.

Another theory is that it was based on an ancient Chinese board game that involved arranging 37 animal figurines into a magic square with numbers that total 666. Dominican monks discovered the game in China and brought it back to Europe.

The Greeks and Romans also had their version of gambling games with a spinning wheel.

Now because people have been playing roulette for hundreds of years, it stands to reasons that strategies have evolved to play roulette. Just for fun, I have listed some of the strategies below:

Roulette Betting Systems

#1 – THE MARTINGALE

Everybody who has played roulette has played this system whether they knew the name of it or not.

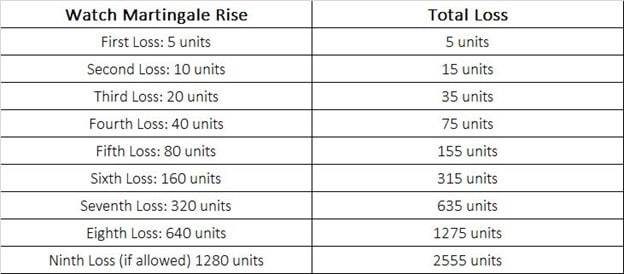

The Martingale method is a double your bet after a loss strategy. So if you lose your first bet (say five units), you then bet 10 units. Win that you make up for the five unit loss and you are now ahead five units.

You will always come out ahead in this system as long as the bets you make are not bigger than your bankroll.

How big a bankroll do you need?

Well, let’s image you are on a losing streak of between seven to nine losses in a row: 5, 10, 20, 40, 80, 160, 320, 640, 1280 etc.

It’s hard to find a roulette table nowadays that lets you bet with anything smaller than a $5 chip.

Therefore, if you start off betting with ONE chip, you better have a bankroll of $6400.

I have vast experience of playing roulette in my twenties and I can warmly assure you that it is very possible to lose 9 bets in a row.

In other words, bankruptcy is not a threat, it’s a guarantee

#2 – THE LABOUCHERE

You take a row of numbers, say 10, 20, 30, 40, 50 with each number representing betting units; the lowest being 10 units for our example. You add the first and last number which is 60 units. With each loss, you add the bet to the end of the line so now the number line is 10, 20, 30, 40, 50, and 60. If you win the next bet (10+60) for 70 units you are ahead 10 units.

You now subtract the 10 and 60. If you lose that bet, you add a 70 to the end of the number string and try again.

Every time you win a bet, the first and last numbers are dropped. If you cancel all the numbers, you have won for that sequence.

The strategy works up to the point you hit a losing streak and you deplete your bankroll.

However, you lose your money in a less dramatic fashion than the Martingale so many gambler’s prefer it.

#3 – THE D’ALEMBERT

Also known as the Gambler’s Fallacy also known as the Monte Carlo fallacy or the fallacy of the maturity of chances is the mistaken belief that, if something happens more frequently than normal during a given period, it will happen less frequently in the future (or vice versa).

For example, if the ball land on red nine times in a row, then the chances of the ball landing on black MUST be higher than if the ball landed on black nine in a row before.

This is a great theory in that it “feels” right. And in the investment world, there are many who implicitly believe in the Monte Carlo fallacy.

There’s only one problem. It’s not true. The ball “has no memory.”

Mind you, there are TONS of people in the world of crypto that believe when it comes to bitcoin the ball “does have a memory.”

But our trading strategies don’t depend on that, at all.

#4 – THE FIBONACCI

Fibonacci is a number system that seems to be found throughout nature and many gamblers use it as a betting system. This is the Fibonacci sequence: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144.

You see the pattern, correct? If not look carefully: 1+1 =2; 1+2 = 3; 2+3 = 5; 3+5 = 8. Every number is the sum of the two that came before it.

Therefore your strategy in roulette is this: You bet 10 units. If you lose you bet another 10 units. If you lose you bet 10 units + 10 units for 20 units — and up, you until you have lost your bankroll.

#5 – THE PAROLI

Paroli is an increase in your bet as you win method of play. You win a 10 unit bet and the next bet is 20 units. You win that bet and the next bet can be 40 units. Think of it as “parlaying” your winnings.

You can stop increasing your bet at any time or just increase with smaller units but up you go with the hope that your winning streak keeps going.

The idea of “parlaying” your bets is also very prevalent in the investment world, as it “cut your losses and let your winning stocks run.”

Like other systems, it works well up to the point that it doesn’t.

#6 – THE CHAOS

Because chaos itself is actually a branch of scientific study, some people out there actually think it’s a valid betting system.

Does it make any sense? No. However, here is how it works:

Roulette “chaosticians” say you must not think about what you are about to bet. Just jump into the game and throw bets all over the layout in no particular order or amount.

I have used this system in the past, after ordering one too many free drinks at the casino. Does it work? After five double-scotches, who cares?

#7 – THE GRAND MARTINGALE

Here you increase your bet not by doubling after a loss but by tripling after a loss. I just include this betting system because it actually exists. I mean somebody gave a name to it.

It’s just stupid.

There Are Two Ways to Win At Roulette

I just told you all the ways to lose at roulette. It doesn’t matter that gamblers have been trying variations of the above seven systems for hundreds of years, it can’t be done.

Here is why: The standard roulette has 36 numbers, with 18 red and 18 black.

In European roulette, there is also the number zero, which is colored green. In North American there is zero and double-zero, because American casinos are impatient and want your money faster.

If you bet on either red or black, over the long run, the zero will come up once every 37 spins (in Europe)

.

Or put to another way, you will lose 1/37 of your bet over the long run. It doesn’t matter what system you play EVERY bet you make, you lose on average 1/37 of your wager, or 2.7%.

These odds are immutable.

HOWEVER, there are two ways a “roulette” player can make money.

I AM NOT RECOMMENDING THE FIRST METHOD, although other people have made fortunes in the past doing what I am telling. I am recommending the second method.

But enough of the suspense, here is how you do it.

Method #1: OPM (Other People’s Money)

If you place YOUR money on the green felt, you are bound to lose it sooner or money. The key is not to put YOUR money on the table.

Let’s take a ridiculous example. Suppose you have a friend Chad who is convinced there is big money to made playing roulette. But he can’t make to Vegas as he has fear of flying.

You agreed to act as his proxy. Chad is especially excited because you have a marvelous new roulette strategy that almost-positively-guaranteed to make money.

He gives you ten grand. He agrees to give you 20% of his winnings.

You fly to Vegas, and miracles of miracles, you get on a hot streak and double Chad’s money.

You fly home and give Chad his original $10K back plus another $10K minus your $2k commission.

And guess what, a funny thing happens. Not only does Chad want you to fly to Vegas the following week, he told him his friends all about your wonderful visionary roulette strategy and now Brad, Sue, and Michael all want to give you $10K.

Now you are flying to Vegas with $40k of OPM (other’s people’s money).

Now you can’t lose. You either double the stash and make yourself a cool $8K just for a weekend’s work in Vegas or worst case, you lose it all. But it’s not your money, so who cares.

Maybe you do something smart and divvy up the stash into four separate gambling sessions. At each one of the sessions, you stop when you have lost that part of the stash, or until you double.

Maybe you just get drunk and then throw down the entire $40 on one spin of the wheel. Your choice.

But you – YOU- never lose any money.

Now at this point in the narrative, you are probably thinking to yourself, this is stupid, whoever gets somebody to go to Vegas to GAMBLE FOR THEM.

And you are correct. Nobody does that for casino gamblers.

BUT THIS HAPPENS ALL THE TIME IN THE TRADITIONAL INVESTMENT WORLD.

Do you know the standard hedge fund? The ones that only multi-millionaires are allowed to invest into

?

The standard cut for a hedge fund manager is 3% of the equity and 20% of the “winnings,” every year.

What do you need to be a successful hedge fund manager? Two things:

1. A winning year, or even better, a couple of winning years.

2. A “system” for investing that only they understand.

And that’s it.

Method #2: Hedging

We place our bets on both red and black, and we never lose.

The key is that we are not playing roulette in a casino that’s in Vegas or Monte Carlo, we are playing roulette in the world of crypto.

And in crypto land, there is are many different kinds of “roulette wheels” where there is no zero or double.

I repeat, if you play on a roulette wheel that where every number is either red or black, then you are perfectly hedged. You will never lose money, it’s impossible.

But of course, you need one more thing to turn this into a money-making proposition.

Here is the twist. In standard roulette, if you place a bet on either red or black, your bet pays off at two to one.

That’s why if you place an equal amount of chips on both red and black, with every spin, you lose half your chips but win back what you lost immediately.

However, what if we found a “roulette wheel,” where if the ball lands on black, you get paid off at 2 to 1. But if the ball lands on red, you get paid off at 2.1 to 1.

You are guaranteed to make money.

Okay, one last twist, and I have built a roulette wheel that is very close to the kind of “hedges” I see in the world of crypto.

There are “roulette wheels” out there where the sum payout of betting on both red and black is always greater than what you bet.

For example, there’s a wheel where black pays out 2.5 to 1 but red only pays out 1.8 to 1.

Or there is another wheel where red pays out 3 to 1 but black pays out 1.7 to 1.

In all these examples, if you hedge (put chips on both red and black), you are guaranteed to make money.

But in many cases, people don’t hedge and always chase the higher payout. So they put money down on black which pays out 2.5 to 1 but red comes up ten times in a row and they lose their bankroll.

That happens a lot in the world of crypto. Volatility wipes out unhedged investors time and time again.

Hedging will not make you rich anytime soon. Hedging is not sexy. Hedging guarantees that you are always losing a bet somewhere.

And hedging is hard and requires research. My example of the magical roulette wheel is just that, an imaginary construct to help you understand what a hedge is and why you should hedge.

But Before We Go Any Further, Here is a Confession:

Before I was a successful investor, I was an unsuccessful gambler. So unsuccessful in fact, that my girlfriend (now my wife of 20+ years) convinced me to go to gambler’s anonymous for a number of years in the 1990s.

I admitted I had a gambling problem, but do you know what I thought was the solution at the time?

I needed to find a casino where the odds were in my favour, not in favour of the house.

Before we can call ourselves “investors” we need to be sure that we aren’t gamblers. We need to understand the “odds.” We need to understand the “house edge.”

Cryptocurrency exchanges like Bitmex and Coinbase generate hundreds of millions of dollars of fees a year and are worth billions. Where did that money come from? From the wallets of gamblers, not investors.

Or, as they say in Vegas, come back and visit your money anytime.

Before we walk into the cryptocurrency “casinos” (where I can show you bets where the odds are in your favour) let’s take a walk around the typical Las Vegas Casino.

Here are House Odds In Vegas on the Top Ten Casino Games

All of these games have two things in common.

1. Play them long enough and you will lose all your money.

2. People play them anyway.

Now before we delve into the mystery of point #2, let’s look the point #1.

Mathematically, the house odds of 1.5% (the best odds in your favour) means that for every $100, you will lose on average $1.50.

Let’s assume that you have a $100 bankroll and you are making bets of $10 each. Therefore, each hand of blackjack is costing you 15 cents to play.

Therefore, you should go bankrupt after (100/0.15) or 667 hands of blackjack.

Assuming each hand of blackjack takes 1 minute to play, you should be able to play 667 minutes or more than 10 hours of blackjack.

But guess what. In my twenties, I walked into casinos many times with $100 and I can count the times on one hand that I managed to make that bankroll last more than 10 hours.

Heck, most times if I got two hours out of that small a bankroll, I called it a lucky night. I guess I was a lousy gambler.

Here is what would happen: Either I would get on a losing streak (in which case my night would end early) or I would get on a winning streak.

And what does a gambler do when he or she gets on a winning streak. They start betting more. And more. Until finally they make a killing or lose all their money.

Do you know what happens when you increase your bet? You increase your rate of loss. The odds never change, it just feels like.

But your rate of loss always increases when you raise the stakes. It’s immutable.

The Tedium of Winning

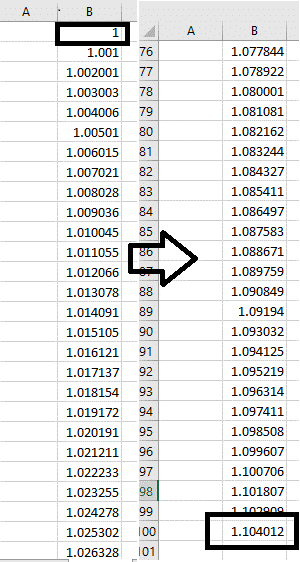

I’m going to show you the results of a spreadsheet that looks incredibly boring. But please bear with me all the same:

This simply a spreadsheet of the number 1 multiplied by 0.1% one hundred times. After one hundred times, you end up with a little more than $1.10 or 10.4% to be precise.

Is 10.4% a big deal or not? That depends on two factors.

Let’s look at point #1. Did it take you a year to return 10.4%?

That’s not bad for a passive investment but we are looking at making one separate investment and that is going to be some work, if not a lot of work.

How about 10.4% a month? That works out to close to 125% per annum. I think that is an excellent return on your investment.

It does mean over the course of one month, that you have to find three or four trades every working day that generate a return of 0.1%.

That’s tough but doable, and in my advanced course, I show you those hedges.

Or let me put it another way, there are roulette wheels out there that pays out 2.002 to 1 when the ball lands on black, and 2.002 to 1 when the ball lands on red.

Do you get those payouts all the time?

No, You see paybacks of 0.1% very frequently, but not consistently. Oftentimes, when the market is slow (like now) the payback is as low as 0.01%.

Therefore your annual return on investment could be anywhere from 125% to 12.5%. That is considerably less exciting.

However, that is not taking into account factor #2: Leverage.

In the world of crypto, there is a lot of leverage available, and most times it is free.

Let’s be “conservative” and say you can leverage your money at 5 to 1.

Now you are looking at an investment return from anywhere from an astronomical 625% down to a still very worthwhile 62.5%

These eye-popping returns are possible with hedge trades that only offer return on your investment of 0.001% to 0.01%. But the keys are velocity (time) and leverage.

I have laid out this investment strategy many times to friends and family and when I come to the final set of numbers, they don’t believe me and think I have pulled some kind of trick.

Therefore, please try this for yourself:

1. Open up and Excel spreadsheet and type in number 1 at the top.

2. Multiply it by 1.01, one hundred times.

3. Okay, imagine making 100 of those trades in one month.

4. Feeling lazy? Fine, cut it in half. You make 50 trades in one month.

5. Leverage yourself by a factor of five

6. That’s your return on your investment. The spreadsheet doesn’t lie.

Conclusion

Did you ever think you would read a trading strategy that demonstrated a return on your investment of 50% to 500% and thought: “That sounds very boring?”

Well, it is. Gambling is fun. Gambling is exciting. Hedging is not. The best hedgers are those with the souls of accountants. There is no joy in what we do, but there is happiness in the money we make to support our families (and our lifestyle).

I will tell you another secret. Once a compulsive gambler, always a compulsive gambler, that’s what they tell you in Gamblers Anonymous.

But I went to Vegas last year for the first time in 25 years with my family on winter break.

I walked through the casinos. I looked at the slot machines, walked past the blackjack table. I stared at the roulette wheels and even watched a few hands of baccarat being played out.

And I felt nothing.

DJ