Running a cryptocurrency derivative exchange can be profitable.

Running an offshore cryptocurrency derivative exchange, not subject to any type of government regulation, can be insanely profitable.

But there is one problem.

The US government takes a very dim view of their citizens patronizing these offshore crypto-derivative exchanges.

Bitmex (offers bitcoin futures, Deribit (bitcoin options) and Biffinex (known for Tether) all ban US citizens from opening accounts and conducting trades, as that would subject those companies to US regulations.

These exchanges much prefer to do business with anonymous customers (although Bitfinex will ask you for identify verification when you do fiat deposits.)

For these companies, following KYC (know-your-customer) and AML (anti-money-laundering) legislation is something to be avoided at all costs.

But the US is a huge market. That’s a lot of money to leave on the table.

Literally the billion-dollar question for these companies is how to do business with US citizens without falling afoul of US regulatory authorities?

And the answer to that is decentralized exchanges.

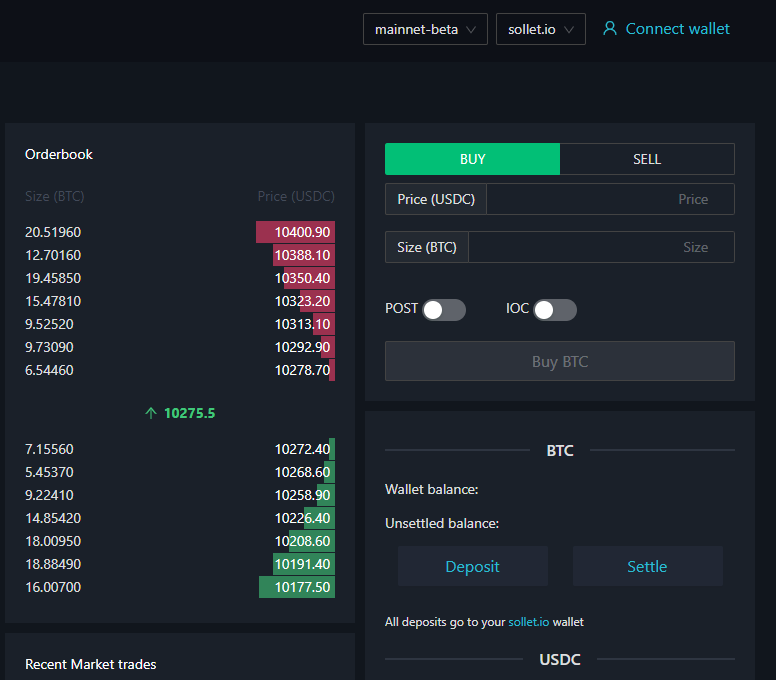

With decentralized exchanges, there is no need for these exchanges to open customer accounts.

That is the say, the assets (USD tokens, bitcoin, Ethereum tokens) never leave the customers’ wallets until the trade is concluded.

(How does a decentralized token exchange work? See my article on Uniswap for the full run-down.)

No customers accounts, no need for KYC/AML compliance. That is going to be the argument that the offshore lawyers are going to be make, someday, when the Securities Exchange Commission (SEC) drags them to court.

Will that be sufficient to stay the heavy hand of the SEC. I don’t know. We will find out someday.

But here is another wrinkle.

Suppose these companies create a decentralized exchange where trading fees are NOT collected by the owners of the exchange itself, but by anonymous third-parties.

Such decentralized exchanges already exist: the trading fees of Uniswap are not collected by the software developers behind Uniswap, but by the stakeholders of the “liquidity pools” that provide the liquidity necessary for trading on the exchange.

That makes things extremely murky. It could take years in the courtroom for any US regulatory to determine if these decentralized exchanges violate US securities legislation.

Actually, it could take years just to find out who is profiting from the operation of these exchanges, let alone dragging them to court.

It’s Already Happening

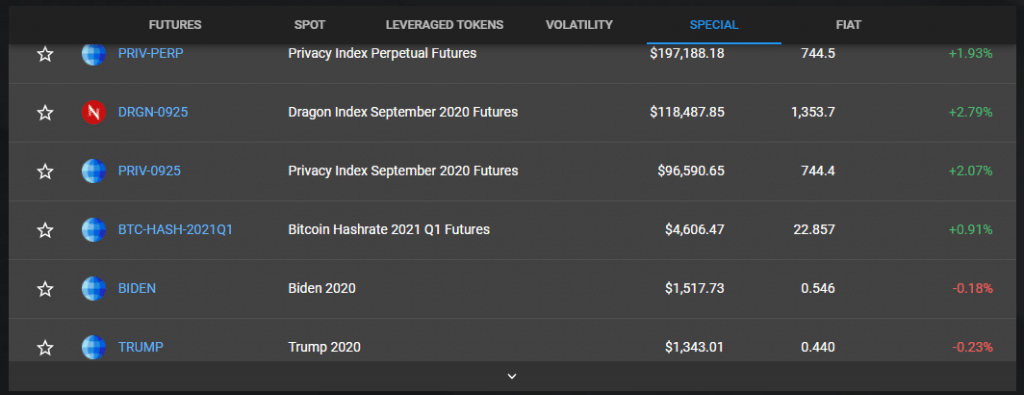

Have you ever heard of FTX? They are an upcoming competitor to Bitmex. They are also known for having the craziest derivatives contracts in all of crypto (and that’s quite an accomplishment).

It’s fully anonymous. All you have to do is connect your Ethereum wallet and start trading.

And FTX can start to offer its services to US customers with the blessing of its lawyers (for now).

But here is where it gets interesting.

FTX has some serious partners in this business.

Jump Trading, a high-frequency trading shop out of Chicago, is backing FTX.

Jump Trading is an American firm and has been around since 1999. They were a backer behind Robinhood’s crypto offerings.

They would not get involved unless Serum had a solid legal case for operating without KYC/AML compliance.

If you want to know “DeFi” is REALLY about, I will tell you: Fully anonymous derivative trading for US citizens.

The invasion has started.

DJ