Investing in public bitcoin mining stocks is like buying cigarette stocks during the 1990s.

The Tobacco Master Settlement of 1998) imposed on tobacco companies a fine of $206 billion over the course of 25 years to offset health costs in the United States

Guess happened next. The stocks soared over the next two decades.

Altria Group (parent of company of Philip Morris and the other tobacco who signed the agreement) had a stock price of $3.43 in 1998 with a dividend payout of 3.57%.

In 2018, it reached an all-time high of $68.87 (1900% gain) while maintaining a dividend of three to five percent.

Put it another way, the payout was more than three dollars or almost the same as the price of the share twenty years earlier!

What does this have to do with public bitcoin mining stocks?

Well, like tobacco companies, they have a license to print money, or I should say, Bitcoin.

The price of bitcoin at the beginning of 2019 was $3764. It’s now more than $10000. But costs for the miners have stayed the same.

Have bitcoin mining stocks been soaring? Yes and no.

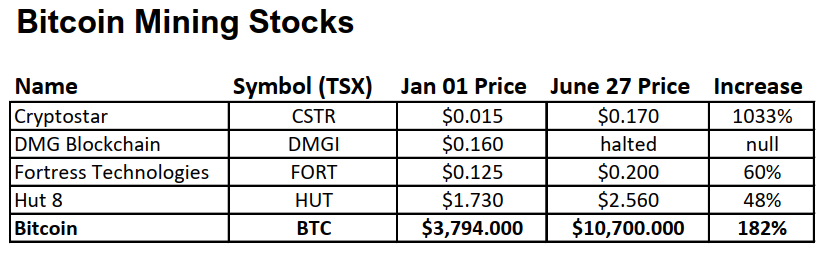

Here is the list of bitcoin stocks that have been covered in New Currency Frontier in over the last year:

Right away you notice that with the exception of Cryptostar (CSTR-TSXv), the stocks have been underperforming as measured against the price of bitcoin (which has gone up 182% this year).

Why is that? The answer is an uncertain regulatory environment.

Look at DMG Blockchain. The stock has been halted since January 29th or for almost five months!

It’s not the only one. Trading has been halted on these mining stocks as well: Hashchain (KASH-TSXv), Hyperblock (HYPR-CNX), and Calyx (CYX-TSXV).

All trading halts have been at the order of the Investment Industry Regulatory Organization of Canada (IIROC). The reasons given for the various trading halts have been varied and unclear.

One reason was that many of the companies were late in filing their year-end due to new auditing guidelines and the shortage of auditors willing to take on bitcoin mining companies as clients.

But various companies filed their annuals (and quarterlies) but for some, the trading halts were still not lifted (Both Hut 8 and Cryptostar suffered trading halts but were then allowed to resume trading).

The uncertain regulatory environment has cast a pall over the industry.

Certainly, Hut 8 (HUT-TSXv) should be trading a lot higher (it traded $3.68 just last September when the price of bitcoin was $6235).

What Does This Mean for the Average Retail Investor?

The multi-million-dollar question to be asked is: Are these trading halts going to lead to eventual delisting of bitcoin mining companies in Canada, or are the regulators finally going to allow trading to resume?

Here is what I think is going to happen (based on conversations with a few bitcoin mining executives and one regulator, none of whom wanted to go on record).

The problem is the “custodial” issue of holding bitcoin. The regulators don’t want bitcoin mining companies to act as pseudo-ETFs for bitcoin. They want to see the companies sell off the bitcoin as quickly as it mined, and in a transparent fashion.

That what Fortress Technologies (FORT-TSXV) is doing. They have leased their mining facilities to a company called WeHash, and never touch the bitcoin, but get a nice cheque from WeHash every month.

Not coincidentally, Fortress Technologies has never had a trading halt (except for a two-hour halt in 2018 as news was pending).

However, Fortress is very conservatively managed, with lots of cash in the bank (which is good) but has limited upside (unless they plan on spending some of $10 million on expansion).

Cryptostar is obviously the winner of the group, keeping in the good books of the regulators with their policy of selling their bitcoin as soon as they mine it.

Is it still a good buy? You be the judge. They mined more than 500 bitcoin last quarter.

Assuming the mining difficulty doesn’t go up (a big assumption, but let’s keep simple it for now), that’s 2000 bitcoin a year.

If bitcoin stays north of $15,000 CAD, that’s $30 million of bitcoin. At present, the market cap of Cryptostar is $39 million.

Draw your own conclusions from that.

Hut 8 looks to be suffering most from the regulatory scrutiny, as there is consistent sell pressure even on days when bitcoin goes up.

In the short and medium term, regulatory uncertainty is killing the share prices of these companies, just like it killed the price of tobacco stocks in the 1990s.

But a deal is going to be worked out between the regulators and these companies.

And then you will see some fireworks.

DJ