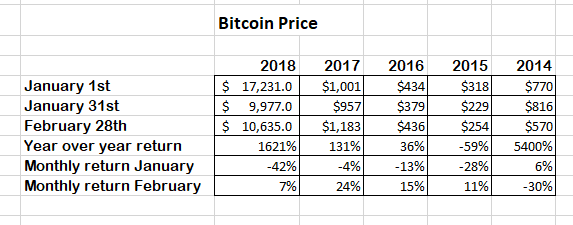

February is generally a turnaround month for bitcoin, rising on average, 5.4%.

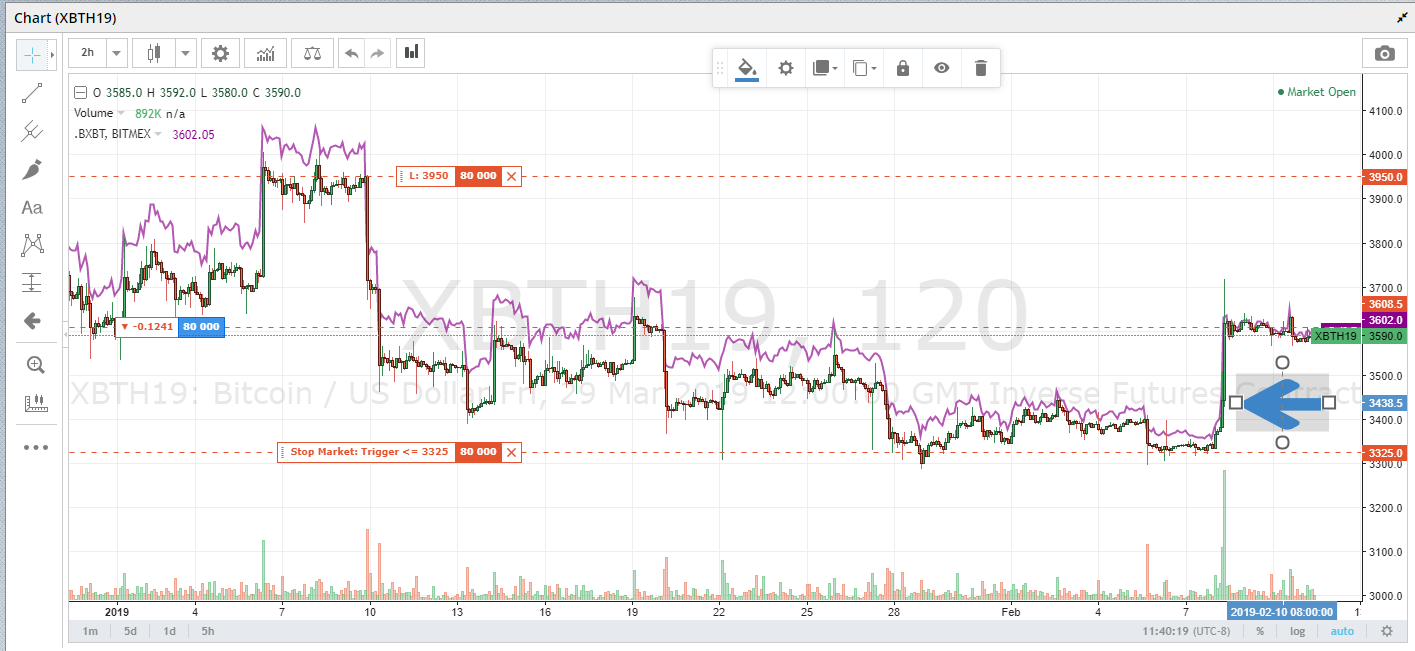

The “smart” money also thinks the end of the bear market is near. Bitcoin future contracts on Bitmex are moving out of backwardation (that occurs when futures are cheaper than the spot price, which is bearish.)

The purple line is spot price of bitcoin. The red and green line is the price of the Bitmex March 2019 Futures. Note the convergence.

Goodbye bear market. But does that mean the start of a bull market?

For that to happen, crypto need the big money to start coming in.

But the collapse of the Canadian crypto exchange QuadrigaCX (with the disappearance of $190 million in crypto) last month did absolutely nothing to convince institutional investors that bitcoin is safe place to put your money.

Serious investors want the traditional financial institutions to handle their bitcoin investments. They don’t want to trust their money to some guy who ran his website out of his house in Nova Scotia.

On February first, it provided an update to the public on the progress in building such a platform.

Bakkt has the backing of Wall Street. Literally.

Intercontinental Exchange (ICE), the public company that owns the New York Stock Exchange, is behind Bakkt.

One other bit of promising news is that, after rejecting at least 10 proposals for a Bitcoin exchange-traded-fund (ETF), an US Securities and Exchange Commissioner has stated that a bitcoin ETF will one day be approved:

How long until we see the glory days of $20,000 bitcoin? There is obviously some work to be done.

The magic word in 2019 will be “custodial”.

What “custodial” means is: can this financial platform be trusted with my money?

Right now, there is unacceptable counterparty risk for any institutional investor to buy bitcoin.

Let’s put in another way. If a hedge fund invests $100 million in Apple stock, it buys the stock through a licensed broker, it doesn’t hold the certificates.

If the broker goes out of business, there is legislation and procedures put in place for the hedge fund to reclaim it’s $100 million of Apple stock.

Presently, there is NO legislation in place that 100% guarantees crypto on deposit at any crypto exchange in the world (but Japan is trying hard). It’s a “trust-me” marketplace when buying and selling crypto.

Even before the QuadrigaCX fiasco, all the institutional money in North American said “no thanks” to that promise.

The Fidelity exchange will partially fill that “credibility gap.”

But Bakkt is the big fish, holding the promise to “mainstream” bitcoin for the big financial institutions

Their goal is to clear the way for major money managers to offer Bitcoin mutual funds, pension funds, and ETFs, as highly regulated, mainstream investments.

The key word is “regulated,” meaning there is no chance of crypto on deposit disappearing down some black hole.

When the Fidelity and Bakkt platforms are fully operational, it will create a huge demand for bitcoin.

How much will the price move?

The price of bitcoin is $3600 USD, giving it a market cap of $64 billion. At it’s peak, in late 2017, market cap was $250 billion.

The current market cap of NYSE is $21 trillion USD.

It’s safe to say with bitcoin we have room to run.

DJ